In the United States, some are native born, some immigrate, but all are unified in pursuing the American Dream.

For most, that includes owning a home. But according to a new report on housing affordability from real estate firm Trulia, there are some places in the country where even doctors struggle when it comes to being able to afford buying a home.

A combination of home prices on the rise and inventory at historic lows has pushed homeownership further and further away from middle-income Americans.

Nationwide, the average American worker earns $37,040 annually, while the median cost of a home is $254,900.

This means that the average American worker would need to spend upwards of 42 percent of their income on mortgage payments. That’s up six percent from only two years ago.

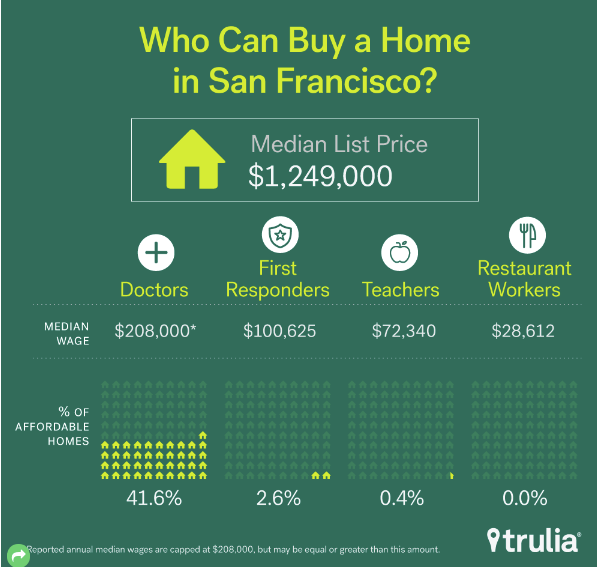

The Trulia report also looked at the incomes of teachers, first responders, restaurant workers and doctors in 100 major U.S. metros, to see where people are struggling most with home affordability.

The findings showed the restaurant workers, with a median average salary of $20,000 struggled the most with home ownership, as they could afford less than ten percent of the homes in over half of the metros surveyed. For teachers, the findings showed that the most unaffordable markets were in the coastal California metros: San Francisco, Los Angeles, and San Diego.

Austin, Denver, and Honolulu were in the top 10 as well.

The best places for teachers were Dayton and Akron, Ohio, Detroit, El Paso, and Syracuse.

For teachers (83 percent), first responders (75 percent), and restaurant workers (32 percent), Middle America offered the best opportunity to own a home.

Most Unaffordable

San Francisco and San Jose, California held the two of the top three spots for least affordable housing in the Trulia study, as both metros hold the highest median listing prices in the country at $1.25 million and $917,903, respectively.

And, that had an impact on workers across the spectrum. Restaurant workers could not afford any of the currently listed homes in these markets, while teachers and first responders could only afford 10 percent of the homes.

Doctors fared better with a median income of $208,000, being able to afford 56 percent of available homes.

While large shares of available homes remain unaffordable to teachers, first responders, and restaurant workers in some the nation’s biggest markets there are pockets of affordability in even the most expensive metros.

In the East Bay in the San Francisco Bay Area, or the Oakland metro area, 8.2% of homes are affordable to teachers. Many of these homes are located in Bay Area cities such as Antioch, Hayward and Union City. Meanwhile, first responders and doctors have even more options with 24.3% and 76.0% of the market affordable, respectively.

“San Francisco stands in a category all its own. It’s sky-high real estate prices are thanks to its small area with a limited number of homes, as well as lots of buyers with very high incomes,” said Investability’s Dennis Cisterna.

Realizing the American Dream with Manufactured Housing

As MHLivingNews have covered extensively, the case for manufactured housing as a viable solution to hope for the American Dream of home ownership at a reasonable price is real. So real in fact, that Bloomberg, Realtor, HousingWire, and Fox News making reports to the same effect.

The ability to significantly cut down on production time, provide a high-quality product to federal standards, all at a lower price point serves as the ideal solution to inventory and housing challenges.

“Bloomberg recently joined those praising our homes, but they suggested we ought to rebrand as tiny houses. Well, you can get small homes from our industry, but we also produce mid-sized-to-larger homes that the working class, the upwardly mobile and frugal millionaires all love,” said L. A. “Tony” Kovach, publisher of MHProNews and MHLivingNews.

Video of home listed in Paradise Cove,

overlooking posh Malibu Beach, CA.

Manufactured Home Prices Are Also Rising, Census Bureau Figures Prove Affordability

The most recent U.S. Census Bureau data on new manufactured home pricing reflects a national average of $71,700 per home, plus the cost of the site. Even in the pricier West Coast region, you’ll find that the typical mutli-sectional – what the Census Bureau dubs a “double wide” in their chart below, are a modest $ 108,900.

Payments on that could be estimated with free online tools. MHLivingNews asked several national industry lenders, and Don Sharp, of Triad Financial Services, rapidly responded with the information found below.

“…the best thing I advocate is our “affordability & payment calculator” on the home page of www.triadfs.com. This gives an AGGRESSIVE & a CONSERVATIVE estimate for loan amount & monthly payment. Aggressive is 700 & above score rates, Conservative is down closer to 600 score rates, both with 10% down rates,” said Sharp.

Even with modestly higher rates than one normally finds on conventional housing, given that the closing costs are routinely lower the total move in and monthly investments tend to be much less on a manufactured home than any other housing option, as even the federal Government Accountability Office (GAO) and Fannie Mae reports have documented.

“The American Dream of home ownership is alive and well, in today’s manufactured homes,” industry expert Kovach said. ##

(Image credits are as shown above.)

Submitted by RC Williams to MHLivingNews.

manufacturedhomelivingnews.com Manufactured Home Living News

manufacturedhomelivingnews.com Manufactured Home Living News