Prior to diving into Ariana Figuero’s insightful report on how mobile and manufactured home residents are “sitting on a time bomb,” let’s be clear. There are two facers and bad actors in pretty much any walk of life one cares to mention. So, it should be no surprise that those who communicate in a different fashion than their behavior occurs in politics. Two faced “Misdirection and Deception” style behavior is found in major as well as minor parties, so it is no surprise when it is found among Democrats as well as Republicans. The author of the article posted below, Ariana Figuero, happens to name several Democrats. Perhaps Figuero is unaware of some of the issues that will be raised by MHLivingNews in the additional facts, analysis, and commentary portion of this report. The same point could be made about the publisher, the Minnesota Reformer, who thoughtfully made Figuero’s article available for republication here below on Mobile Home and Manufactured Home Living News (MHLivingNews).

Note that the highlighting in yellow below is added by MHLivingNews because those fact-claims are in dispute. Further, the term “mobile home” is often misused by millions, so it is no surprise that it is misused without proper clarifications below. More on that in the analysis portion of this article.

‘Sitting on a time bomb’: Mobile home residents at risk in red-hot housing market

BY: ARIANA FIGUEROA – APRIL 11, 2022 6:25 AM

It’s quiet, as most of his neighbors are at work. But he often wonders how many more walks he and his bulldog mix, Ladybug, will have down the streets of the place he’s called home for 21 years.

“We’re literally sitting on a time bomb that we’re sure is going to go off at some point, but we don’t know when,” Zang said.

His park was purchased by an investment company, Walkart Inc., that residents say is trying to change the county zoning laws to close down a community that’s been home to 60 manufactured homes since 1957. Walkart, which could not be reached for comment, wants to build luxury apartments in its stead, according to Zang and a report in the Daily Local News.

“They just want this property to expand their stranglehold on the rental communities of West Chester,” said Zang, who pays $550 a month for his lot compared to an average rent in the area of $1,700 monthly for a one-bedroom apartment.

Mobile home parks provide affordable housing for millions of low-income residents — including seniors on fixed incomes — to own homes while renting the land underneath. The average cost of a manufactured home in 2019 was about $82,000, according to a report by Manufactured Housing Institute, a trade organization representing the industry.

But in an exploding housing market, that land is increasingly in demand for other projects, or park owners propose major rent hikes or changes in leases. Residents have few protections under a patchwork of state laws.

Congress might be expected to step in, since some mobile home parks are bought by private equity firms that use federally subsidized loans that carry low interest rates. But there’s been little movement in Washington, D.C.

“The invisibility of mobile home parks is a huge problem,” Andrew Rumbach, an associate professor with the Department of Urban Planning at Texas A&M University, said.

It’s difficult to understand the scope of people living in these communities, as there is no federal database. But it is estimated that there are 2.7 million mobile homes across 45,600 mobile home parks in 49 states, said Paul Bradley, the president of ROC USA — a nonprofit based in New Hampshire that helps residents purchase their mobile home communities.

What’s more, in the middle of the coronavirus pandemic, some of the most frequent filers of evictions on a county-by-county basis were owners of mobile home parks, according to data collected by Eviction Lab.

For example, the owner of a mobile home community was the top filer of eviction cases in Cincinnati, in Hamilton County, Ohio, with almost 200 eviction files through November 2021, said Jacob Haas, a research specialist at Eviction Lab, a project by Princeton University that collects and publishes the first-ever dataset of evictions in the U.S.

Mobile home park owners were the top 10 filers of evictions in Florida’s Alachua, Duval and Pinellas counties, according to data collected by Eviction Lab.

“It’s not uncommon at all for manufactured home communities to show up among the locations that have the most (eviction) filings during the pandemic,” Haas said.

50 states, 50 policies

During the pandemic, amid sickness and job losses, mobile home park residents also have grappled with rent hikes or revisions of their leases, often with little help from state laws.

“There’s basically 50 different policies for how to protect residents in these parks,” said Esther Sullivan, an assistant professor of sociology at the University of Colorado Denver.

“In many cases, they are disadvantaged by omission, meaning a state usually doesn’t have laws on the books that directly address the rights of park residents and the responsibilities of park owners,” she said.

In the worst case scenarios, some residents must abandon their properties because they can no longer afford to rent the land below their homes.

Cesiah Guadarrama Trejo, a housing advocate who also lives in a manufactured housing community in Colorado, said that when people own their homes but cannot afford the rent hikes, “that will eventually displace people.”

If a resident can no longer afford the plot of land they rent, it’s not like they can move their homes, said Dave Anderson, the executive director for All Parks Alliance for Change, a tenants’ union for residents of Minnesota’s manufactured home parks.

The cost of moving a mobile home — assuming it doesn’t damage the structure — can range from $5,000 to $8,000.

Anderson said the trend he’s noticed in the Twin Cities is out-of-state companies buying parks and trying to rewrite leases.

“There’s a much more aggressive plan for generating profits out of these purchases,” he said.

Some states, like Pennsylvania, have 60-day notice requirements for any rent increases, said Daniel Vitek, a staff attorney at Community Justice Project in Pennsylvania. But there’s no state law to prevent aggressive rent hikes, he added.

Vitek said one protection that Pennsylvania gives mobile home park residents is a requirement for six months notice of a park’s closure, and the owner of the park must pay for the appraisal of the mobile home. Depending on the appraisal, that homeowner might be compensated for the worth of the manufactured home.

“I don’t want to make it sound like Pennsylvania is a great place to live in a mobile home park because even though it has its own statute and provides for a lot more protections than, say, a tenant in just a normal landlord-tenant relationship, they’re still pretty weak protections,” he said. “And the tenants are at the mercy of a bad owner quite a bit.”

Where’s Congress?

The invisibility of mobile home parks extends to the federal level, despite deep government involvement in the housing and mortgage industry that is supposed to prop up the availability of low-income housing — especially manufactured housing.

“We need people to be able to see these places and see what they are and what value they have and then make good, intelligent policy decisions to protect people who live there,” Rumbach said.

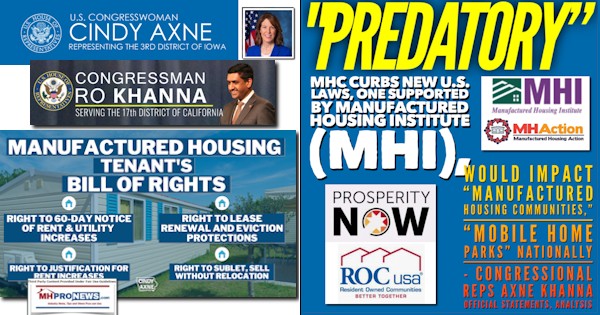

U.S. Rep. Cindy Axne, D-Iowa, introduced legislation last year that would extend tenants’ rights to help residents get at least a 60-day notice of rent increases.

In a statement to States Newsroom, Axne said movement on legislation for manufactured housing has stalled since the president’s social spending plan, known as Build Back Better, died in the Senate.

The House passed its version of the bill that included a $500 million Manufactured Housing Community Infrastructure Improvement Grant program that would have helped resident-owned groups and nonprofits in buying and preserving manufactured housing communities.

Sen. Catherine Cortez Masto, a Nevada Democrat, introduced a stand-alone Manufactured Housing Community Infrastructure Improvement Grant program in November.

The chairman of the Senate Banking Committee, Democratic Sen. Sherrod Brown of Ohio, sent a letter in January 2020 to the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation — the government-sponsored enterprises known as Fannie Mae and Freddie Mac. Brown questioned how many manufactured housing communities are being bought by private equity firms that obtained billions in low-cost loans through those entities.

Brown noted there is little data available on private equity’s involvement, and that Freddie Mac and Fannie Mae are just two outlets for financing, but said Congress needs a better understanding of the situation.

“I have seen first-hand how residents in these communities, many of whom are elderly and have fixed incomes, have experienced rent and other housing cost increases with few consumer protections,” the Ohio Democrat said in a statement.

Brown, along with Axne, traveled to Waukee, Iowa, to visit residents of Midwest Country Estates, a mobile home community that had been recently bought by a private equity firm in Utah, Havenpark Capitol. Axne said many of the residents experienced a 70% increase in rent hikes from the firm.

Brown in his letter raised numerous questions about Fannie Mac and Freddie Mac and the effect of private equity firm ownership on manufactured housing. The Senate Banking Committee declined to share the responses received from the two agencies.

At a recent Senate Banking Committee hearing, Sen. Elizabeth Warren, a Massachusetts Democrat, criticized private equity firms for creating a housing crisis, especially for seniors in mobile home parks.

“So Wall Street investors buying up manufactured home communities threatens the remaining affordable housing stock that seniors rely on,” she said.

“It means that seniors have fewer opportunities to age in their own homes and that they risk being squeezed by rising rents, leaving them even with less money to buy medicine and to put food on the table. Congress needs to act to weaken the investors’ grip on the housing market.”

Debate over federal protections

The most recent federal action came from Freddie Mac in September of last year, when the agency announced some tenant protections on all future Manufactured Housing Community sales “that go above and beyond current state and local requirements.” Some of those protections include a renewable year-lease term, 30-day notice of rental increases and a 60-day notice if the park will be sold or permanently closed.

“Manufactured housing communities often represent the most affordable multifamily housing option available in many areas, particularly rural areas,” Debby Jenkins, the executive vice president of Freddie Mac Multifamily, said in a statement. “We have been ramping up our tenant protections offering since 2018, and today we’re making these protections a requirement for all future transactions.”

Axne said she was hopeful of these protections the agency announced, but still believes congressional action must be taken.

“I am encouraged by actions like what Freddie Mac did last fall to finally make their tenant site lease protections universal for all of the MHCs they finance, but do believe more can be done,” Axne said.

But housing advocates like Guadarrama Trejo have said the updates from Freddie Mac and Fannie Mae are toothless.

Guadarrama Trejo, who works as an associate state director for the working women’s advocacy group 9to5 Colorado, said that many of the tenant protections that Freddie Mac issued are less stringent than some standards in Colorado.

Guadarrama Trejo said the guidelines requiring a 60-day notice for a closure of a park is not a lot of time “for what can potentially put someone in displacement.”

“We’re talking about people who would lose everything,” she said.

Sullivan, the sociology professor, said that in the last 20 years, many private companies have realized how profitable manufactured housing communities can be and have started to acquire them from traditional mom-and-pop operations. She added that it’s such a popular investment that there is a Mobile Home University course where investors can learn how to purchase those communities.

“They’re a favorite investment item of those who are interested in passive income,” she said. “And that’s because many park owners are looking for investments that require minimal upkeep, maintenance, and capital investment.”

And for residents who want to purchase their communities, known as a resident-owned cooperative, it’s an uphill battle, said Nick Smithberg, the executive director at Iowa Legal Aid.

“There’s no present owners under any obligation to sell to any particular group of tenants,” he said, referring to Iowa’s laws.

If a park were to go up for sale, a handful of states offer what is known as a first refusal, which means it obligates the community owner to sell to the residents if they match the terms of the other offer. But only Florida, Minnesota and New Jersey have such first refusal laws.

Pressure on Freddie and Fannie

A coalition of about 20 affordable housing groups is pushing for Freddie Mac and Fannie Mae to do more to help residents of mobile home parks, such as assisting them in acquiring capital to purchase their communities.

“Amid a housing affordability crisis that requires bold and aggressive action, Fannie Mae and Freddie Mac have set forth plans that fail to effectively reach those not served or not served well by the conventional mortgage market,” the coalition wrote to FHFA Acting Director Sandra Thompson.

Jim Gray, a senior fellow at the nonprofit Lincoln Institute of Land Policy, said Freddie and Fannie have two mission requirements. The first is an affordable housing goal, which “requires them to purchase a certain percentage of mortgages that support low income communities,” and the second is the “duty to serve clause.”

“The duty to serve was something that Congress passed to complement the affordable housing goals, and what it does is it requires Fannie and Freddie to make greater efforts to reach three historically underserved markets,” he said. “And those markets are manufactured housing, rural housing, and affordable housing preservation.”

Bradley, the president of ROC USA, said Freddie Mac and Fannie Mae could help low-income groups of neighbors purchase their communities by lowering the upfront capital requirement needed to obtain a loan to purchase a community.

But without approval to be flexible in their equity investments from FHFA, Freddie and Fannie Mac’s hands are tied.

“If you’re going to meet the needs in low-income neighborhoods, like mobile home parks, you got to have some flexibility,” Bradley said.

Bradley said that he’s hoping when Thompson, who has been nominated as FHFA’s director, is confirmed, she’ll allow those entities to be more flexible in their “duty to serve” clause.

He said that none of the 20,000 homeowners in the nearly 300 resident-owned communities where ROC USA has helped secure financing has gone into foreclosure, arguing that the resident-owned co-op model is a success.

“These groups of homeowners have proven themselves, these co-op borrowers have proven themselves, and it’s still not good enough,” he said. “And that’s what annoys everybody.”

Bradley added that an effective way to help residents of manufactured housing communities is to pass opportunity to purchase laws, which allow residents to match a third party’s offer to buy their community.

Bradley said that such options are “perhaps their once-in -a-lifetime chance to get control of the land under their homes.”

“And at the end of the day, we ought to have owners on land that they own and control and not on the land of a commercial investor,” he said. “That’s the bottom line.” ##

Additional Facts, Insights, Analysis and Commentary

As a programming note, our Manufactured Home Pro News (MHProNews.com) sister site plans a report that has those insights and others from the Lincoln Institute’s CEO in the near term. Watch for it.

That segue noted, McCarthy indicated that he and his colleagues are in the process of refining some of the estimates provided by Figueroa. But at this time, the following from them and other sources are worth noting to clarify points made by Figuero in her article.

- Of the estimated roughly 9 million manufactured and pre-HUD Code mobile homes in the U.S. today, about 4.3 to 4.4 million of them are sited in a land-lease community, which are often (though not always accurately) described as a “mobile home park.”

- Note that per MHI, about 31 percent of new manufactured homes today go into a land-lease community, so the balance of some 69 percent presumably ends up on privately owned land.

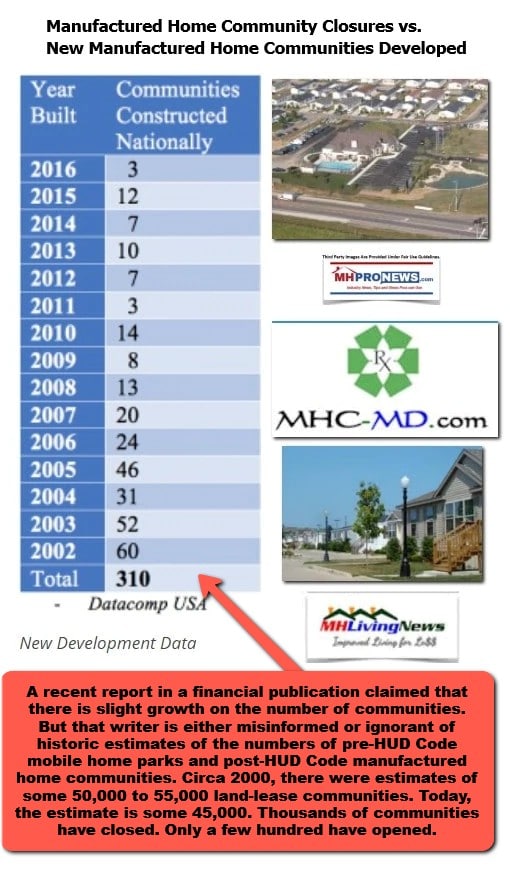

- MHI is among those who have oddly inaccurately provided estimates for years on the number of land-lease communities found in the U.S. They were reporting 38,000 just a few years ago, and since they surely know that more manufactured home communities (MHCs) have been closing than opening in the 21st century, as they more recently report some 44,000 MHCs, they have not explained why they adjusted that reckoning. McCarthy thinks the correct count of MHCs is closer to 46,500. Around the turn of the century, common estimates ranged from 50-55,000 MHCs.

So, in fairness to Figueroa, it is no surprise that her figures on that point are disputed and those that she used are apparently too low. But as manufactured home industry experts, it is our goal to provide the most factually accurate picture possible based on currently known insights. Figueroa cited Paul Bradley, with ROC USA. But it is difficult to say from her report what source(s) Bradley relied upon. His organization is an MHI member. So, MHI may be in mix of the ‘sources’ of those quoted statements from Bradly.

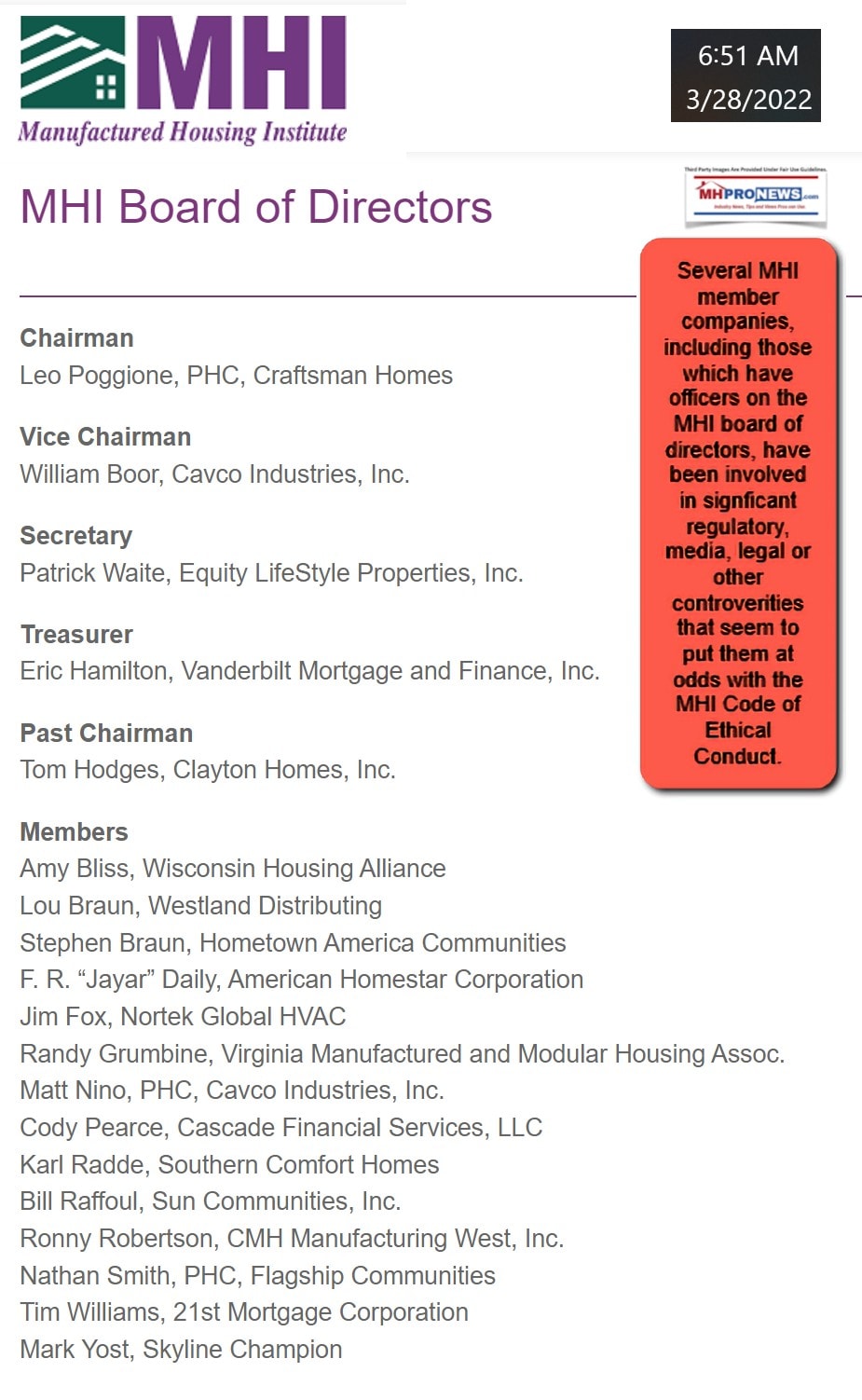

The world of pre-HUD Code mobile homes (built before June 15, 1976) and post HUD Code manufactured housing (factory-built homes built to national federal standards administered by the U.S. Department of Housing and Urban Development (HUD) is all too often found to be examples of two faced, paltering, “deception and misdirection” types of behavior. While MHI claims to represent “all segments” of the industry, they are credibly accused of in fact favoring the interests of larger brands that are often accused of engaging in “predatory “behavior.” A look at the MHI board of directors provides some insight. Several of the firms below have been involved in troubling legal, regulatory, and media-research supported concerns brought forward from their respective customers.

As noted at the top of this article, something similar could be said about people in almost every profession, including conventional rental housing and new construction that have left their owners heartbroken have their own problems, as the report linked here that includes a mainstream news report documented. Definitions and examples of the distinctions between mobile homes and manufactured homes – which have similarities, but are NOT the same housing products – are found in the report linked below.

Minnesota Reformer author Ariana Figueroa covered a lot of ground in under 2400 words. Every article an author, this one included, has to decide what to include and what to leave out. Additionally, in the case of Figueroa, one or more editors may be involved. Editors also may have guidelines on length or other factors that cause an article to be framed at the length and content that is ultimately presented to the public once published.

That said, Figueroa’s article mentioned several prominent Democratic lawmakers. These included Senators: Sherrod Brown (OH-D), Elizabeth Warren (MA-D), Catherine Cortez Masto (NV-D), Cindy Axne (IA-D), and of course Joseph R. “Joe” Biden (D), who has the White House as his work and primary residential address when he isn’t visiting one of his getaway properties. For clarity and emphasis, because Figueroa mentioned Democrats, what follows will be about Democrats. But just as there are DINOs – Democrats in Name Only, there are RINOs (Republicans in Name Only). Meaning, the analysis that follows should not be considered partisan, but rather clinical.

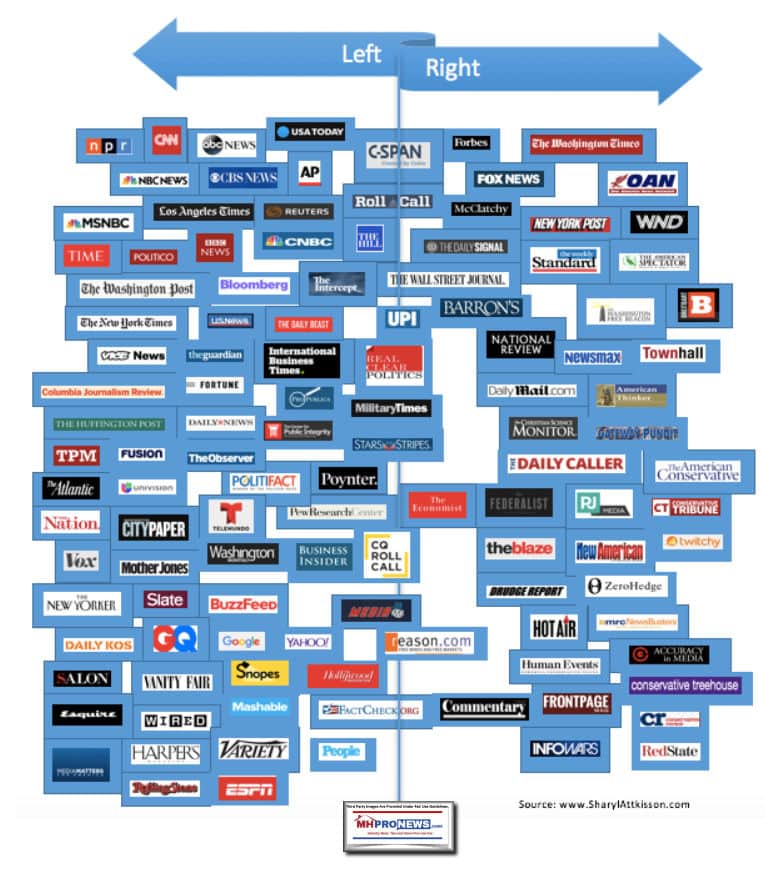

Often pro-Democratic publications, such as the New York Times have been periodically noting for some years that Democrats have become a favored party of the wealthy. Given that some of the richest people in America, and thus the world, are prominent backers of Democrats, it is no surprise that the NY Times, the Washington Post, and other left-leaning publications have had to periodically acknowledge the issue and related concerns. Some examples are shown and linked below.

https://www.nytimes.com › 2015/10/07 › how-did-the-…

Oct 7, 2015 — On economic issues, however, the Democratic Party has inched closer to the policy positions of conservatives, stepping back from championing the …

https://www.nytimes.com › U.S. › Politics

Jul 26, 2022 — That big question was the focus of a Tuesday gathering of progressive lawmakers, activists and scholars.

https://www.nytimes.com › 2017/06/01 › opinion › demo…

Jun 1, 2017 — During his primary campaign against Hillary Clinton, Senator Bernie Sanders, a self-proclaimed socialist, lived up to the grand Democratic …

https://www.nytimes.com › U.S. › Politics

Jan 29, 2022 — Then came the 2020 election. Spurred by opposition to then-President Trump, donors and operatives allied with the Democratic Party embraced dark …

Here are some examples from the left-leaning Washington Post. In a rather humorous point, the Washington Post is owned by Jeff Bezos, who many place in that ‘top tech billionaire’ category. See the prior and seemingly related MHLivingNews report, linked above.

https://www.washingtonpost.com › 2016/05/31 › tech-b…

May 31, 2016 — The tech elite are almost exclusively backing Democrats this election cycle: Tesla’s Elon Musk donated to Hillary Clinton; Facebook’s Mark …

https://www.washingtonpost.com › 2021/12/09 › are-de…

Dec 9, 2021 — Jared Golden, a Democrat, represents Maine’s 2nd Congressional District in the U.S. House of Representatives. In the weeks ahead, Democrats …

https://www.washingtonpost.com › 2021/09/16 › despit…

Sep 16, 2021 — Despite the slogans, the polling and even the infamous white ballgown, Democrats appear to be getting cold feet on “taxing the rich.”.

https://www.washingtonpost.com › politics › 2020/07/16

Jul 16, 2020 — They include: billionaire investor George Soros ($500,000), Facebook co-founder Dustin Moskovitz ($620,600), billionaire hedge fund founder and …

This is a pattern that MHLivingNews and our MHProNews sister site has previously highlighted on several occasions. Why? Because the facts and evidence often support the claim. Once more for balance and clarity, there are DINOs as well as RINOs.

This matter plays out noticeably in manufactured housing. Let’s pull some observations from about four years ago on MHProNews that provided clear links between prior MHI Chairman Nathan Smith, who is currently a partner in publicly-trade Flagship Communities, which was previously known as SSK Communities. Smith is a prior MHI chairman and is still an MHI board member.

Home Shopping Consumer Alert – BBB “F” Rated SSK Communities Rebrands As Flagship Communities

Smith, said the left-leaning Gannett (think USA Today, see illustration below) owned Cincinnati newspaper, has long been a Democratic Party stalwart. In a report with analysis and commentary dated 9.25.2018, the following statements are found, many of which are attributed to Gannet’s Cincinnati.

Erlanger, KY is across the Ohio River and near Cincinnati, Ohio. Fort Mitchell, KY is nearby too. So, it is no surprise when a successful business professional and highly-visibly Democratic supporter was covered in a profile by Cincinnati, which said as follows.

“After Nathan Smith was born, his parents brought him to a single-wide mobile home perched on the side of a mountain in southeastern Kentucky.”

If you check the dates, that dwelling would indeed have been a true pre-HUD Code mobile home.

Here is an extended quote from that same source. The brown text for direct quotes are added by MHProNews.

Smith has since leveraged his success in business to become one of the most effective and influential Democratic fundraisers in Kentucky.

“For the last 10 or 12 years, Nathan has probably been the most energetic and committed political and financial backer of Democrats from Northern Kentucky,” Kentucky Attorney General Jack Conway said. “He is an indefatigable supporter of Democrats.”

Conway, also a Democrat, recalls campaigning in southeastern Kentucky when he heard he needed to meet Smith’s parents in Bimble, a small community outside of Barbourville.

“The next thing I knew, the car was pulling up a little road alongside a junkyard on the side of a hill,” Conway said. “I asked for Nathan’s father and a guy spit out his tobacco and said, ‘You found him.’ ”

Smith has never forgotten the values he learned during his humble upbringing, Conway said.

“Nathan has a big heart,” Conway said. “If he is supporting you, he doesn’t just write you a check. He wants to get his friends behind you. He is one of the best in state at gathering support for you.”

Cincinnati is part of the USA Today group of media publications. As Sharyl Attkisson’s media bias infographic above reflects, USA Today leans left, or put differently, they are more pro-Democratic than Republican (GOP). You can finish their article on Smith, at this link here.

Smith has considerable ties to Warren Buffett led Berkshire Hathaway owned Clayton Homes, and 21st Mortgage Corp. See more in the related reports, linked above or further below.

As or more revealing, Smith has ties to former President Barack Obama, Secretary Hillary Clinton, and is an active, long-time Democratic supporter. Various key U.S. Senate, gubernatorial, and other races will be influenced by Smith’s campaign support.

Smith’s support has included, but is not limited to, Sherrod Brown (D-OH), and Joe Donnelly (D-IN). According to federal filings, both Brown and Donnelly have reportedly received MHI PAC funds.

SSK’s leader is quoted by MHI as saying, “The Manufactured Housing Institute Political Action Committee (MHI-PAC) is the only federally-registered PAC dedicated to supporting bipartisan federal candidates who support manufactured and modular housing as an essential homeownership option. MHI-PAC allows MHI members from every segment of the industry to pool permissible, voluntary personal financial contributions to support federal candidates for the U.S. Senate and U.S. House of Representatives. Thank you to all MHI-PAC contributors who are advancing our industry’s dedication to providing affordable, quality homes and financing to all families.”

— Nathan Smith, Chairman of the MHI-PAC and Partner at SSK Communities

That’s an interesting commentary by Smith. Why? Weren’t Democrats the party that passed Dodd-Frank, that throttled manufactured housing lending for years? Didn’t Democrats pass ObamaCare, which laid heavy burdens on small businesses, and kept millions of workers from having a single, fulltime, living-wage jobs? How can MHI staff or the MHI Executive Committee board members look their members in the face, and still claim that they’ve worked to advance the interests of small businesses, or manufactured home industry lending?

Isn’t there ample evidence that the opposite is true? Recall the comment linked below from former MHI VP Jason Boehlert, who admitted in writing that with Barack Obama in the White House, the CFPB wouldn’t change their rules or regulations on industry lending?

Industry Voices

While commentators will be picking over the remains of the 2012 elections for weeks to come and discussing what the political landscape will look like over the coming year and what impact the elections will have as Congress prepares to return for a lame-duck session, MHI wanted to provide members with some feedback and analysis of the immediate aftermath and outlook for the coming weeks.

Aren’t the disconnects between what MHI – and what some of their leaders, like Nathan Smith – say and do in stark contrast to what they posture and proclaim in their messages and meetings?

In fact, then-President Obama threatened to veto MHI’s Preserving Access, had it passed. These are among the reasons that facts, evidence, and history all matter.”

MHARR White Paper Exposes Public Relations Exploitation Notwithstanding Continuing Industry Failures

Smith’s SSK turned Flagship Communities was among those featured in HBO’s Last Week with John Oliver misnamed but viral video, Mobile Homes. Oliver smashed Warren Buffett, Clayton Homes, and several brands tied to MHI, as MHLivingNews documented below. While Smith wasn’t directly named, a video clip of a resident of Smith’s was shown by Oliver’s video.

HBO’s John Oliver on Last Week Tonight Mobile Homes Video, Manufactured Home Communities Fact Check

For whatever reasons, what neither Oliver nor Figueroa noted are the routine ties of Democratic politicians to money received from MHI’s PAC and/or from company officials that are tied to “predatory” manufactured housing brands.

MHLivingNews has strived to accurately convey the stated positions of people like Rep. Axne (IA-D) and Senator Sherrod Brown (MA-D).

This publication also clearly reported how Senator Elizabeth Warren (MA-D) publicly called out several of the brands that Oliver and others have called predatory.

But what is often lacking are the additional ‘connect the dots’ elements that this report’s analysis is hereby providing. When politicians criticize a problematic behavior, but then are taking campaign donations from sources that are engaging in that type of behavior, what is that if not two-faced?

MHLivingNews has been promoting the notion for some years that what is needed is effective antitrust, RICO and Hobbs Act, etc. law enforcement. An example of that is linked below.

In fairness to the Minnesota Reformer, a pair of articles by Justin Stofferahn have made similar points. “Democrats Need to Become Anti-Monopolists Again” and “We’ve Fought Monopoly Power Before — We Can Do it Again.” MHLivingNews plans to do a report on those items by Stofferahn. This post will be updated with a link to that, as they present related points useful in conjunction with this report and analysis. In short, much that Stofferahn said is on point. His points are similar to concerns raised by Minnesotan James A. “Jim” Schmitz Jr., with the Minneapolis Federal Reserve.

To draw to a conclusion for now, to effectively fight what’s gone wrong in affordable housing in general, and manufactured homes too, antitrust, RICO, and the Hobbs Act should arguably be effectively deployed. There is no need, in this writer’s view, to delay by waiting for ‘new’ legislation. The laws needed to fix these issues already exist. Additionally, as has been reported here for years, the ‘white hats’ in this industry are often the mom-and-pop sized operations that seek to serve their customers rather than exploit them as some of the large firms are accused of doing. To learn more, see the related reports, linked below.

Discerning Quality, Value, Seller Ethics – Faithful Lifeway Homes, “Can I Bring My Cousin?”

MHLivingNews Note: volunteer resident-advocate Bob Van Cleef has since gone on to his eternal reward. He is missed.

That’s a wrap on this installment of “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Celebrities, Millionaires, Billionaires and Their Appealing Manufactured Homes

Lifestyles of the Rich and Frugal: Manufactured Mansions Take Their Place in the California Sun

manufacturedhomelivingnews.com Manufactured Home Living News

manufacturedhomelivingnews.com Manufactured Home Living News