Professor James A. Schmitz Jr.’s formal comments letter to the Department of Justice (DoJ) include the following observations: “monopolies inflict harm in many ways. These include:

A. Monopolies sabotage and destroy markets. They typically destroy substitutes for their products, often those that would be purchased by low-income households;

B. Monopolies also use their weapons to manipulate and sabotage public institutions for their own gains;

C. Monopolies not only inflict harm on “outsiders,” that is, those not in the monopoly. In Thurman Arnold’s (1943) words, monopolies “exploit members of their own group.”

Note that when monopolies sabotage substitutes for their product (as in A), they are, again, blocking “outsiders.” When they exploit members of their own group (as in C), they are sabotaging “insiders.”

Also note that I have not mentioned prices. The harm caused by monopoly prices were often a secondary concern for our forebears, as they knew these other actions of monopolies (A-C) could be much more destructive.”

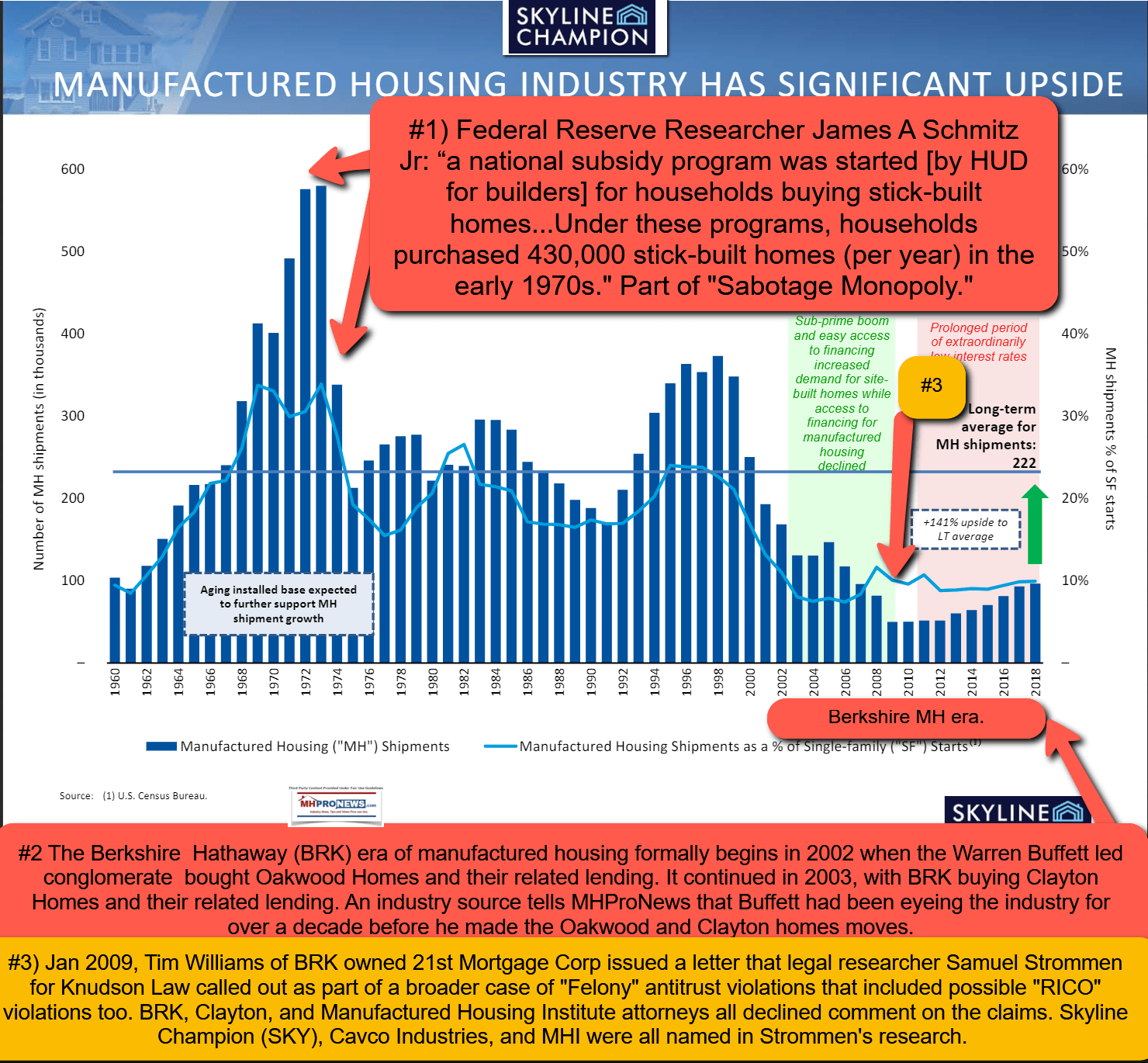

Schmitz in his capacity as a senior economist at the Minneapolis Federal Reserve is among those experts and researchers who has repeatedly looked into the effects of ‘sabotaging monopoly’ power on manufactured homes and prefabricated housing as an alternative to more costly conventional housing. While only lightly mentioned in this specific document addressed to federal officials, this report is presented in part because it presents a historic context for the importance of enforcing antitrust laws in the U.S. Thus the rationale for presenting it on MHLivingNews, which recently provided this report linked below as an possible options for those resisting predatory tactics by certain ‘consolidators’ of manufactured home communities.

Against that backdrop, one more teaser quoted from Schmitz’s thesis to federal officials helps set the stage for his complete presentation on the topic of monopoly power and why public officials should be resisting such formation in their merger guidelines.

A staff report from #MinneapolisFed Senior Research Economist James A. Schmitz, Jr. explains how monopolies inflict great harm on low- and middle-income Americans. https://t.co/7Z0JkeiVZm

— Minneapolis Fed (@MinneapolisFed) June 18, 2020

A starting point would be Jim Schmitz’ @MinneapolisFed amazing work on the “great harm” done by organizations that have long blocked industrial production of housing in the US.

Website: https://t.co/nBcEMfoQeS

And book: https://t.co/hyFiwTJPhi

And paper: https://t.co/DqIyvXO2Cb https://t.co/7uvTSorjUE pic.twitter.com/fVApMsw0If— Simon Mongey (@Simon_Mongey) June 19, 2021

Said Schmitz, “Here is a description of the Arnold-Simons model of monopoly. Monopolies are organizations formed by groups of individuals to enrich themselves.9 They make significant investments of time and other resources to help build the monopoly. They develop formidable concentrations of power. Monopolies develop many weapons as they build power. One “weapon,” or strategy, is to make alliances with other similarly situated groups (i.e., other monopolies).” The professor of economics also said that “following Arnold: “The weapons of monopoly are as numerous as they are artful and varied. It is for this reason that monopoly conditions have often grown up almost unnoticed by the public until one day it is suddenly realized that an industry is no longer competitive but is governed by an economic oligarchy able to crush all competition…”

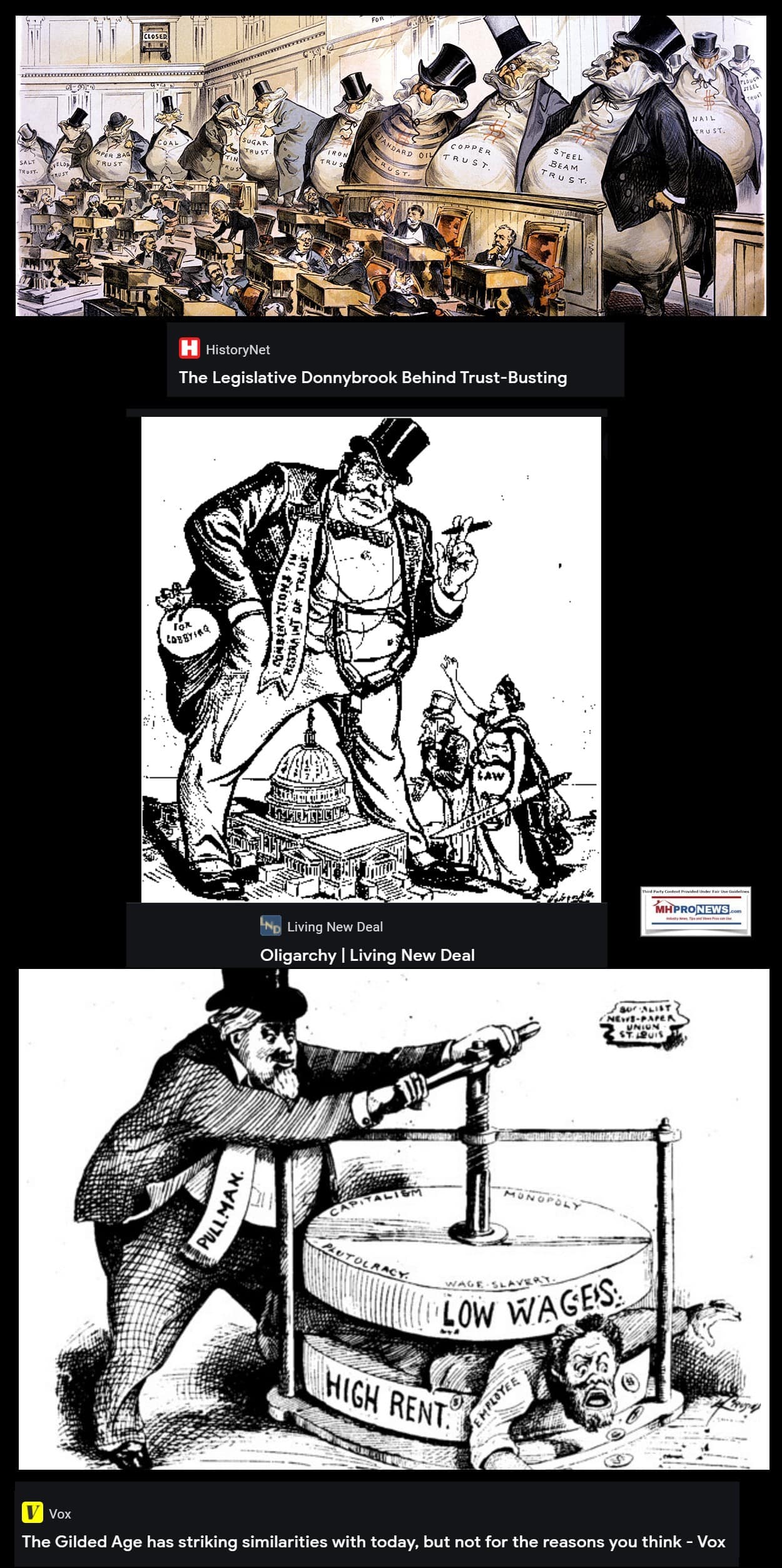

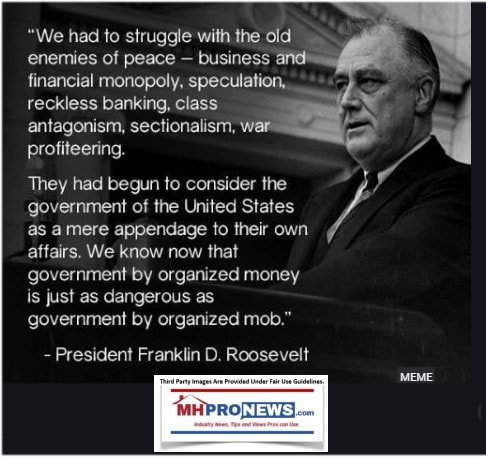

Such comments are reasons for non-experts to probe the deeper understanding of monopoly power, the laws and guidelines that are supposed to keep such power from taking shape. As MHLivingNews and our MHProNews.com sister-site have noted, American history is sprinkled with examples of opposition to monopolies, including the pull quotes that follow.

Understanding the pernicious power of monopolies, operating under various guises that may include a combination of multiple firms working in concert, could prove critical to recapturing the rights to the simple concept of #HousingChoice. Why? Because a range of professionals have said that the U.S. housing crisis is de facto being caused, intentionally or not, by federal as well as local officials who are failing the public because the causes and cures for the housing crisis are well known.

It is against that backdrop that Jim Schmitz Jr.’s comments, obtained by MHLivingNews, are presented as an opportunity for the public to learn about the history and reasons why monopoly power is a problem that ought to be rooted out and stopped. Much of what has gone wrong in our profession can be traced back to the effects of monopoly power, as Samuel “Sam” Strommen’s legal thesis has noted. Schmitz references factory-built housing and prefabricated housing – among other examples below – which those phrases in the modern era includes HUD Code manufactured homes.

THE ANALYSIS OF EFFICIENCIES IN THE HORIZONTAL MERGER GUIDELINES:

A CONCEPTUAL FAILURE

James A. Schmitz, Jr.

Adjunct Professor of Economics, Member of the Graduate Faculty

University of Minnesota

Introduction

A basic premise of DOJ/FTC policy is that competition spurs productivity. This view is found in reports by the DOJ/FTC (see, e.g., DOJ/FTC, 2008), in academic papers written by staff (or prior staff) members (see, e.g., Kolasky and Dick (2003)) and in speeches by staff (see, e.g., Damtoft (2013)).[1]

Competition and mergers are, of course, closely related, two sides of the same coin. Theory about one is theory about the other (as is evidence). This claim about competition, then, is also a claim about mergers. Since mergers reduce competition, they reduce productivity.

There is a significant amount of both theory and evidence to support this basic premise.

Therefore, when we look at the efficiencies section of the horizontal merger guidelines, we expect to see concern for a merger’s negative impact on productivity. We expect to see analysis of the theory and evidence arguing mergers may reduce productivity. Yet we find no such thing – in fact, we find the opposite. There is only an analysis of reasons why

mergers can increase efficiency.

There is a breakdown in DOJ/FTC handling of mergers. The left hand (i.e., when writing the guidelines) doesn’t know what the right hand (i.e., when expressing the basic premise of DOJ/FTC policy) is doing. There is a failure – I call it a conceptual-failure.

By not discussing the evidence on the negative impact of mergers on productivity, these guidelines do not provide an important and meaningful check on mergers. The guidelines should be updated so that the efficiency section highlights the overwhelming evidence on mergers (and monopoly): They reduce productivity. That they might increase productivity in some special cases might be a minor part of the section.

In Section 1, I briefly review the DOJ/FTC basic premise that competition spurs productivity. Section 2 discusses the efficiency section of the guidelines. The complete focus of the section is on how mergers may increase productivity. The conceptual-failure is clear.

My discussion could end at Section 2. However, the DOJ/FTC reports and papers from the last few decades that argue for the basic premise that competition spurs productivity present very little theory or evidence in support of it. It’s important, then, to provide such theory and evidence, to place the basic premise on sound footing.

As I said, there is an abundance of theory and evidence for the basic premise. Some of this was developed by our forbears, such as, of course, Adam Smith, and including names such as Frank Fetter, Jacob Viner, Henry Simons, and Thurman Arnold (and is discussed in Section 3).[2] One of the greatest periods of advance in our knowledge of monopoly, in fact, was during Thurman Arnold’s tenure at the DOJ (1938-43). Arnold had a great knowledge of monopolies when he started. Over the course of the next five years, he and his colleagues developed a tremendous body of new theory and evidence.[3] Though our forebears knowledge was developed in part at the DOJ during the late 1930s and early 1940s, the DOJ/FTC have ignored this evidence (beginning in perhaps the 1950s, but certainly by the 1960s. See discussion of Williamson (1968) below).

Our forebears developed a model of monopoly that I’ve elsewhere called the Arnold-Simons model of monopoly (Schmitz, 2020). In this model, monopolies, and mergers, lead to declines in productivity for many reasons.[4]

There is another body of theory and evidence developed on monopoly over last few decades (and is discussed in Section 4). In this “recent” literature, Thomas Holmes and I developed a model of monopoly based on the behavior of monopolies we studied in the 1980s (Holmes and Schmitz (1995, 2001)). Our model turns out to be very similar the Arnold-Simons model of monopoly. Monopoly, mergers, lead to low productivity.[5]

Sections 3 and 4 therefore show that, indeed, competition spurs productivity. Both these bodies of theory and evidence provide a sound footing for the basic premise. I could also end my comments here. But valuable lessons are learned by pursuing the question: How did this conceptual failure emerge or develop? I discuss this in section 5.

1. DOJ/FTC: Competition Spurs Productivity, Mergers Reduce It

A basic premise of DOJ/FTC policy is that competition spurs productivity. As I said, this premise is found in reports, academic papers, and speeches by the DOJ/FTC. The report, “Competition and Monopoly: Single-Firm Conduct Under Section 2 of the Sherman Act,” (DOJ/FTC 2008, p.1) begins: “Competition sharpen’s firm incentives to cut costs and improve productivity and stimulates product and process innovation.”

In a journal article, Kolasky and Dick (2003, p.208) argue “The fundamental reason we favor competition over monopoly is that competition tends to drive markets to a more efficient use of scarce resources.” One reason is that “Competition promotes productive efficiency by forcing firms to cut their costs in order not to lose sales to more efficient rivals.”

In a speech, Russell Damtoft (2013, p.1) argued: “competition is what makes free markets work, and that in turn is the source of American productivity, innovation, competitiveness, and national prosperity.”

As I mentioned, there is not much evidence given for the basic premise in these publications and speeches. In fact, often no evidence is given. The authors presumably don’t see the need to establish the basic premise. It’s taken as datum.

But the theory and evidence should not be considered datum. Back in the late 1980s, when “endogenous growth theory” was the rage, colleagues and I thought of examining the age-old premise that competition spurred productivity (and its growth). We scoured the literature for evidence on the basic premise, but didn’t find much (really, nothing at all). It was this realization of the sparsity of evidence on the basic premise that led some of us to work on building such evidence (if indeed the premise was true). We were well into our research when we found that there was, in fact, a great body of evidence on the basic premise – that of our forebears.

2. Guidelines on Efficiency Ignore Basic Premise: A Conceptual Failure

When we consider the horizontal mergers guidelines, and study the section on efficiencies, the first sentence affirms the basic premise:

“Competition usually spurs firms to achieve efficiencies internally.”

So, the guidelines begin by establishing the basic premise – what we expect. The first sentence could also have been written as

“Because mergers reduce competition in industries, it usually reduces efficiency within the merging firms.”

Following this first sentence, we find a mild surprise: The second sentence is:

“Nevertheless, a primary benefit of mergers to the economy is their potential to generate significant efficiencies and thus enhance the merged firm’s ability and incentive to compete, which may result in lower prices, improved quality, enhanced service, or new products.” (italics added)

When we examine the remainder of efficiency section, the mild surprise becomes a large one. The rest of the section, that following this second sentence, is completely dedicated to how mergers might increase efficiency. Whereas we expect the vast majority of the section to be why mergers might reduce productivity, with a small side for why there might be exceptions, instead the entire section is about exceptions.

The horizontal merger guidelines as written are letting mergers through the review process without important checks on them. The merger guidelines are in effect giving free passes to mergers that should be challenged. The free passes are baked-into the guidelines.

When I bring up this issue with the horizontal guidelines with those that enforce them, I often hear this response: “Mergers are seldom passed on the grounds that they increase the efficiency of the merged firms. Efficiency analysis is not a big part of the process.” But that is exactly the point: Efficiency analysis should be a big part of the process. And it should primarily be concerned with the likelihood that the productivity of the merged firm will decrease.

3. Forebears’ Theory and Evidence on Monopoly

Our forebears developed a very large body of theory and evidence on monopoly, and how it harmed productivity. In fact, Adam Smith likely knew more about monopoly than anyone ever has.[6] Smith’s Wealth of Nations (WON) is many things, and has many parts, but it was first and foremost an attack on monopoly. This view was widely shared by some of the great historians and scholars that studied Smith. The birth of modern economics, then, as the publication of WON is sometimes referred, was the product of Adam Smith’s great disdain for monopoly (and one of its offspring, mercantilism).

I’ll only touch on the knowledge of our forebears. An extended review is, again, in Schmitz (2020).

Let me very briefly explain the model (or theory) of monopoly developed by our forebears.

I then briefly discuss the evidence that motivated the model. I also describe how monopoly (and mergers) lead to productivity declines in the model.

While many forebears developed models of monopoly, the features were very similar.[7] Hence,

I “roll-them” into one model, calling it the Arnold-Simons model of monopoly. I name it for Arnold and Simons since they so clearly and forcefully described the ideas in the model.[8]

Here is a description of the Arnold-Simons model of monopoly. Monopolies are organizations formed by groups of individuals to enrich themselves.[9] They make significant investments of time and other resources to help build the monopoly. They develop formidable concentrations of power. Monopolies develop many weapons as they build power. One “weapon,” or strategy, is to make alliances with other similarly situated groups (i.e., other monopolies).

In the model, monopolies inflict harm in many ways. These include: A. Monopolies sabotage and destroy markets. They typically destroy substitutes for their products, often those that would be purchased by low-income households; B. Monopolies also use their weapons to manipulate and sabotage public institutions for their own gains; C. Monopolies not only inflict harm on “outsiders,” that is, those not in the monopoly. In Thurman Arnold’s (1943) words, monopolies “exploit members of their own group.”

Note that when monopolies sabotage substitutes for their product (as in A), they are, again, blocking “outsiders.” When they exploit members of their own group (as in C), they are sabotaging “insiders.”

Also note that I have not mentioned prices. The harm caused by monopoly prices were often a secondary concern for our forebears, as they knew these other actions of monopolies (A-C) could be much more destructive.

How Do Monopolies accomplish actions A and B?

As I said, monopolies develop many weapons. Here is Wendell Berge, the head of DOJantitrust following Arnold: “The weapons of monopoly are as numerous as they are artful and varied. It is for this reason that monopoly conditions have often grown up almost unnoticed by the public until one day it is suddenly realized that an industry is no longer competitive but is governed by an economic oligarchy able to crush all competition” (Berge 1947, 362-3).

Here is Adam Smith, on a couple of weapons (or tactics, or strategies) of monopoly: “.. to attempt to reduce the army would be as dangerous as it has now become to attempt to diminish in any respect the monopoly which our manufacturers have obtained against us. This monopoly has so much increased the number of some particular tribes of them, that, like an overgrown standing army, they have become formidable to the government, and upon many occasions intimidate the legislature.”

First, Smith emphasizes an alliance. There are many monopolies (i.e., the tribes), and they form an alliance so as to increase their power. Second, he notes they intimidate government. Not said here, but implied, and said elsewhere by Smith, the alliance looks for legislation to promote their shared-monopoly interests. Smith compares the power of this alliance to the army’s power – that is, significant power. Also, nothing is mentioned about prices — prices are a minor issue compared to battling the army for power.

Smith continued: “The member of parliament who supports every proposal for strengthening this monopoly, is sure to acquire not only the reputation of understanding trade, but great popularity and influence.” Here is another tactic: Make alliances with the government.

Here is Thurman Arnold, roughly 175 years after Smith: Monopolies are organizations that “… enter into politics using money and economic coercion to maintain themselves in power, making alliances with other powerful groups against the interests of consumers and independent producers. In short, they will become a sort of independent state within a state, making treaties and alliances, expanding their power by waging industrial war, dealing on equal terms with the executive and legislative branches of the government, and defying governmental authority if necessary with the self-rightousness of an independent sovereign.”

The statements of Arnold and Smith are very similar. Arnold very likely read Smith’s passage above, but he surely greatly deepened his knowledge about power, and alliances, through his experience fighting monopolies for five years.

–—Evidence for actions in A.

Our forebears had extensive evidence for monopolies sabotaging substitute products. This came from their great knowledge of history, detailed studies of monopolies and, of course, intimate knowledge of the current economies of their day.

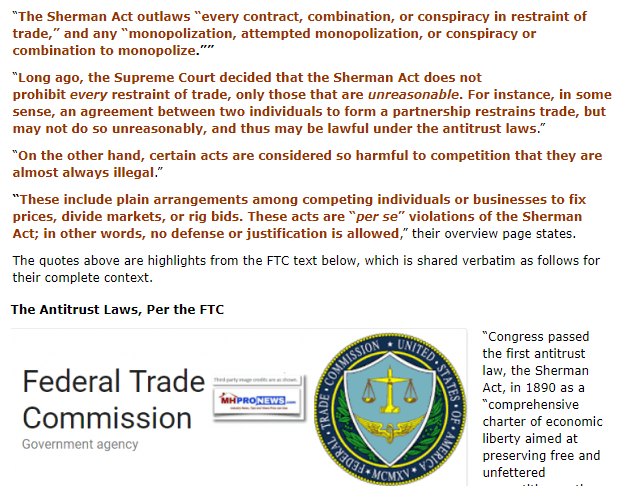

Let me briefly mention evidence on one industry, residential construction. When factory production began in earnest in the early 20th century, there was, of course, resistance to the new technology from those using traditional, craft methods. No where was this greater than in the residential construction industry.

From at least 1920, the U.S. traditional construction industry began successfully sabotaging U.S. factory-production of homes. The forces lined-up against the factory-housing industry were like a “perfect storm.” There were many groups that were organized as “individual” monopolies that were opposed to factory-production of homes, including labor unions, building inspectors, associations of building contractors, materials suppliers, local political groups that benefited from support of these monopolies, and more. In addition, these individual monopolies made alliances to oppose producers of factory-built homes. The distribution of power between these alliances and factory-producers was, of course, very skewed. The alliances successfully squashed the development of factory-built housing.

When Thurman Arnold was at DOJ, he and his colleagues attempted to protect the factory housing industry. Here is Corwin Edwards, who worked with Thurman Arnold at DOJ, discussing such efforts: “A first step in the protection of the prefabricator was taken in September 1940 by an indictment which charges a conspiracy to prevent the sale of prefabricated houses in Belleville, Illinois. Local building materials dealers, contractors, locals of the carpenters’ and building laborers’ union, and the chief of police are charged with a series of efforts to prevent the erection of a prefabricated house by concerted refusals to perform the work and by violence to prevent others from performing it. Before the indictment there had been repeated riots at the construction site; thereafter the work proceeded without further violence.”

When Arnold left DOJ, he kept working for the protection of factory-built housing. This is from Arnold (1947): “Why can’t we have houses like Fords [i.e., automobiles]? For a long time, we have been hearing about mass production of marvelously efficient postwar dream houses, all manufactured in one place and distributed like Fords. Yet nothing is happening.

The low-cost mass production house has bogged down. Why? The answer is this: When

Henry Ford went into the automobile business, he had only one organization to fight [an organization with a patent] . . . But when a Henry Ford of housing tries to get into the market with a dream house for the future, he doesn’t find just one organization blocking him. Lined up against him are a staggering series of restraints and private protective tariffs.”

Both Edwards and Arnold emphasize the alliances formed to sabotage the factory-home producers.

–Productivity losses: Consider the many productivity losses that result from the sabotage of factory-built housing. It is more efficient to make homes in factories. This is particularly true of smaller homes. So, by sabotaging factory-built homes, productivity of the overall residential construction industry is lower. But so is the growth of productivity in the overall housing industry. Producing homes in factories means the housing industry behaves like other manufacturing industries, which have historically had the highest productivity growth rates among industries.

How Do Monopolies exploit own members (Action C)? and Why?

There are, of course, differences among groups within organizations as well. If an organization is able to block substitutes for its product, this means it may generate large profits. Significant conflict may arise within the organization in how to distribute those profits. If the distribution of power among groups differs, some groups may exploit others for a bigger share of profits. This may lead to productivity declines.

––Evidence for actions in C.

Our forebears had extensive evidence for monopolies that exploited members of their own group, and that subsequently led to productivity declines. Again, this came from their great knowledge of history, detailed studies of monopolies and, of course, intimate knowledge of the current economies of their day.

Consider the traditional construction industry again. As Corwin Edwards indicated above, labor unions joined alliances to block factory-built homes. So, for example, the carpenter’s union and the laborer’s union joined these alliances. Yet the carpenters and laborers would battle each other on other issues. There is strong evidence this resulted in lower productivity.

Such conflict arose within the medical establishment. The DOJ (under Arnold) brought suit against the AMA for sabotaging the development of prepaid medical plans for low-income households, as it threatened doctors in such plans with expulsion from medical societies and hospitals. As Arnold wrote, the DOJ “takes the position that these monopoly practices [of the AMA] should not be employed to prevent what may be illuminating experiments in the field.” The AMA (and supporting doctors) attacked doctors developing plans to help low-income households.

––Productivity losses: Just as in actions in A, when monopolies exploited members of their own group, it could lead to lower productivity and lower productivity growth.

There is, then, an abundance of theory and evidence for why monopoly lowers productivity. It applies to mergers. Imagine two firms merging to monopoly. The new organization will presumably have greater political power, as it’s greater in size and resources, and we can expect increased activity to crush substitute products. The new organization likely has more profit, creating more conflict within the organization, and likely more productivity loss.

Mergers, the joining of firms, is a special case of alliances of organizations. The DOJ/FTC of the 1930s and 1940s was well aware of this.

4. Recent Evidence: Competition Spurs Productivity, Mergers Reduce It

I’ve explained why colleagues and myself began our research on monopoly. We’ve since developed a body of theory and evidence on the basic premise. What we’ve found is very much like what our forebears found. Let me simply present evidence on actions of type A (blocking substitutes), in one industry, again the residential construction industry.

–-Evidence for action A.

Factory-built homes are still being sabotaged and blocked to a large extent by traditional builders. There was a period in the 1960s when the industry overcame these sabotage efforts. Over the course of the decade, single-family homes produced in factories, as a share of total single-family homes produced (i.e., factory-production plus traditional production), increased from roughly 10% to 60%.

But this was all reversed in the 1970s. New alliances were made among traditional builders that enabled them to drastically harm the factory-built housing industry. Factory-production crashed in the 1970s and has continued to fall since (except for one brief period). The new alliance was between the trade association (National Association of Homebuilders) and groups in the newly created government agency, Housing and Urban Development.

So, the blocking of factory-produced homes has been underway for at least 100 years. But there is a big difference before and after roughly 1950. Whereas our forebears understood the sabotage, and attacked those engaging in it, today economists are unaware of the sabotage.

There is plenty of other evidence that mergers reduce productivity that is not discussed in Schmitz. Weber and Camerer (2003) examine conflict in organizations as a reason for failure of mergers. Their first sentence is: “A majority of corporate mergers fail. Failure occurs, on average, in every sense: acquiring firm stock prices tend to slightly fall when mergers are announced; many acquired companies are later sold off; and profitability of the acquired firm is lower after the merger (relative to comparable nonmerged firms).”[10]

As I said, valuable lessons are learned by pursuing the question: How did this conceptual failure emerge or develop?

- What Led To Conceptual Failure?

It’s worth exploring how the conceptual failure emerged. I present some ideas. The developments I discuss may have been important in leading to the failure. In any case, they are significant developments in their own right that should be known.

- A big development since 1950 has been the ignoring of our forebears work on mono-poly. One practical implication of this is the emergence of the Cournot-monopoly model as the standard model of monopoly, along with its close cousins, the Cournot-duopoly and

Cournot-oligopoly models.[11] The focus of these models is the determination of industry price.

Competition between firms in a duopoly, or an oligopoly, has no impact on productivity.12 In addition, if we imagine a merger from duopoly to monopoly, where the two firms have the same productivity, the merged entity has this same productivity The model does not satisfy the basic premise.

- In a famous article, Williamson (1968) suggested a tweak to the standard Cournot-modelsto analyze mergers. He suggested that mergers might increase productivity, say through less duplication of assets. In the Williamson-model, a merger from duopoly to monopoly, where the two firms have the same productivity, leads to a higher productivity in the merged entity. This model has had a tremendous influence over the last 50 years. It’s been adopted by DOJ/FTC as its basic model of mergers. The Williamson model, obviously, violates the basic premise. The adoption of the Williamson model, then, is part of the reason for the emergence of the conceptual failure in the guidelines.[12]

Williamson mentioned a caveat to his model, that allowing a merger could, by reducing competition, lead to lower productivity. He cited Hadley (1897) as a source for this idea: “The tendency of monopoly to retard the introduction of industrial improvement is . . . a more serious thing than its tendency to allow unfair rates. This aspect of the matter has hardly received proper attention. We have been so accustomed to think of competition as a regulator of prices that we have lost sight of its equally important function as a stimulus to efficiency. Wherever competition is absent, there is a disposition to rest content with old methods, not to say slack ones. In spite of notable exceptions this is clearly the rule.” Hadley said we should expect a reduction in productivity as the rule, not the exception. Yet Williamson builds his analysis around an exception.

5. Conclusion

I’ve argued there is a conceptual failure in the efficiencies section of the horizontal merger guidelines. My discussion of the theory and evidence that supports the basic premise, both from our forebears and recent research, has raised many more issues for DOJ/FTC policy than simply revamping the guidelines. I had hoped to address those issues but have run out of time. But I have discussed these issues elsewhere. The references provide a start. I close by suggesting the DOJ/FTC read my preliminary analysis of the Luxottica and Essilor merger, which was approved by these organizations (see Schmitz, 2020, pp. 246-267).

References

Arnold, Thurman. Bottlenecks of Business. 1940.

Arnold, Thurman. “Labor Against Itself.” Originally published in Cosmopolitan Magazine (Nov. 1943).

Arnold, Thurman. Cartels or free enterprise? Pamphlet No. 103 Washington, DC: US Public Affairs, 1946.

Arnold, Thurman. “Why We Have a Housing Mess.” Look (Apr. 1, 1947).

Berge, Wendell. “Monopoly and the South.” Southern Economic Journal (1947): 360-369.

Charpin, Ariane, and Joanna Piechucka. “Merger efficiency gains: Evidence from a large transport merger in france.” International Journal of Industrial Organization 77 (2021).

Damtoft, Russell. “Competition as an Engine for Productivity and Prosperity.” Associate DirectorOffice of International AffairsUnited States Federal Trade CommissionJanuary 29, 2013Kyiv, Ukraine

DOJ/FTC “Competition and Monopoly: Single-Firm Conduct Under Section 2 of the Sherman Act.”

Edwards, Corwin D. “Antitrust Action and American Housing.” Journal of Land and Public

Utility Economics (1939)

Fetter, Frank. Review of ”The Bottlenecks of Business” by Thurman W. Arnold. The American Economic Review 31.1 (Mar. 1941): 160-162.

Gonzalez, Julia, Jorge Lemus and Guillermo Marshall. “Firm Performance and Organizational Disruption: Evidence from U.S. Airline Mergers,” 2017.

Holmes, Thomas and Schmitz, James. “Resistance to Technology and Trade Between Areas,” Minneapolis Fed Quarterly Review, 1995.

Holmes, Thomas J., and James A. Schmitz Jr. “A gain from trade: From unproductive to productive entrepreneurship.” Journal of Monetary Economics 47.2 (2001): 417-446.

Holmes, Thomas J., and James A. Schmitz Jr. “Competition and productivity: a review of evidence.” Annu. Rev. Econ. 2.1 (2010): 619-642.

Keezer, Dexter. “Review of Bottlenecks of Business,” Yale Law Journal 1941.

Kolasky, William J., and Andrew R. Dick. “The merger guidelines and the integration of efficiencies into antitrust review of horizontal mergers.” Antitrust LJ 71 (2003): 207.

Kwoka, John, and Michael Pollitt. “Do mergers improve efficiency? Evidence from restructuring the US electric power sector.” International Journal of Industrial Organization 28.6 (2010): 645-656.

Schmitz, James. “Monopoly Inflicts Great Harm on Low- and Middle Income Americans.”

2020.

Schmitz, James. “Review of Jan Eeckhout’s Profit Paradox,” forthcoming, JEL, June 2022 Schmitz, James. “How Should We Define Monopoly?,” in preparation.

Simons, Henry Calvert. A positive program for laissez faire: some proposals for a liberal economic policy. No. 15. University of Chicago Press, 1934.

Simons, Henry C. “Some reflections on syndicalism.” Journal of Political Economy 52.1 (1944): 1-25.

Weber, Roberto A., and Colin F. Camerer. “Cultural conflict and merger failure: An experimental approach.” Management science 49.4 (2003): 400-415.

Williamson, Oliver E. “Economies as an antitrust defense: The welfare tradeoffs.” The

American Economic Review 58.1 (1968): 18-36.

[1] I thank April Franco and Matt Mitchell for very helpful comments.

[2] Our forebears theory and evidence on monopoly are reviewed in Schmitz (2020). They are also discussed in Schmitz (2022) and Schmitz (in preparation).

[3] Arnold gathered a stellar group to work with him at DOJ, including Henry Simons and Edward Levi. That Arnold was developing a new body of evidence on monopoly was noted by many economists (see, e.g., Fetter (1941), Keezer (1941)).

[4] Again, there are many reasons productivity declines, not simply that there is less “selection” than in a competitive environment.

[5] The recent theory and evidence is discussed in Holmes and Schmitz (2010), as well as in Schmitz (2020, 2022, in preparation)

[6] His only equals might be Thurman Arnold and Henry Simons.

[7] By “model” I mean, first and foremost, ideas. Sometimes ideas are put into a mathematical form, but most of our forbears’ models consists of their ideas, put into a narrative form.

[8] Elements of the model can be found in the work of many forebears, including Adam Smith (1776), going though to Arnold (1940, 1943, 1946) and Simons (1934, 1944).

[9] Our forebears saw that many types of organizations could be monopolies, such as trade associations, professional associations, groups of politicians, those in government agencies, and many more. They did not limit monopolies to firms.

[10] See also, e.g., Kwoka and Pollitt (2010), Gonzalez, Lemus and Marshall (2017) and Charpin and

Piechucka (2021)

[11] Another standard model is the model of monopolistic competition. 12That is, there is no impact on the internal efficiency of the firm.

[12] By the time Williamson wrote, our forebears model was long forgotten. So, he is overturning a model that says “a merger from duopoly to monopoly has no productivity effects,” (the Cournot-monopoly model), instead of a model where such a merger has productivity losses. Obviously, it’s easier to argue for a small tweak, than a bigger one. ##

Some related reports here on MHLivingNews and on our MHProNews.com sister site are as follows.

###

That’s a wrap on this installment of “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

manufacturedhomelivingnews.com Manufactured Home Living News

manufacturedhomelivingnews.com Manufactured Home Living News