“While MHI claims to support growth, CEO Lesli Gooch’s recent Maine testimony—which disparaged the resident-owned community (ROC) model—is cited as a specific example of MHI working to protect existing land-lease monopolies rather than expanding the industry through the legal tools available.” So said left-leaning Google’s artificial intelligence powered Gemini in response to evidence supplied to it that included the testimony of Manufactured Housing Institute (MHI) CEO Lesli Gooch to the Maine Housing and Urban Development Committee of the Maine state legislature (see Part II). To be clear, this bill passed despite MHI’s objection. But the testimony of Gooch, and the fact checks by third-party AI systems, paint a picture of what AI has described as part of a ‘monopolization’ scheme (see Part II) that limits options for residents and affordable housing seekers.

MHI CEO Gooch’s testimony (see Part I) to the State of Maine’s legislature and public officials largely speak for itself.

This MHVille facts-evidence-analysis (FEA) is underway.

Part I

TESTIMONY FOR THE RECORD

The Manufactured Housing Institute

Before the:

Maine Housing and Urban Development Committee

Regarding:

LD 1145

April 16, 2025

Thank you for the opportunity to submit testimony on behalf of the Manufactured Housing Institute (“MHI”) in strong opposition to LD 1145, titled “An Act to Protect Residents Living in Mobile Home Parks.” This written testimony is intended to supplement the oral testimony given by MHI CEO, Dr. Lesli Gooch, and includes information requested by Committee members during the hearing.

The Manufactured Housing Institute (MHI) is the only national trade association that represents every segment of the factory-built housing industry. Our members include builders, suppliers, retail sellers, lenders, installers, community owners, community managers, and others who serve our industry, as well as 48 affiliated state organizations. In 2024, our industry built 103,314 homes which were produced by 38 U.S. corporations in 152 homebuilding facilities located across the country. About thirty-percent of newly constructed manufactured homes are placed in land-lease communities.

MHI has been a leader in working to support quality homeownership through land-lease manufactured housing communities. Through our National Communities Council, MHI has adopted a Code of Ethics, which outlines eight principles that NCC members must subscribe to as part of their membership with MHI. These principles focus on promoting the benefits of manufactured housing and land-lease communities, as well as customer and resident relations. This includes engaging in conduct and actions that promote and enhance the public image of manufactured housing and land-lease manufactured housing communities and promoting positive customer and resident relations as an essential responsibility.

On behalf of MHI, I urge you to carefully consider the implications of this bill on the existence of manufactured housing communities in Maine, which have been a source of quality and affordable unsubsidized housing for half a century. We are concerned the legislation will be harmful for those who live in manufactured housing communities because it will drive out capital at a time when aging communities are in need of funding and stability to preserve aging infrastructure. While the goal of the bill is admirable, the solution is detrimental as it will inevitably lead to community deterioration and community closures. The bill’s blunt and economically harmful mechanism actually undermines the goal advocates seek, which is to preserve one of Maine’s most effective affordable housing models.

MHI urges you to carefully consider the implications of this bill. While well-intentioned, LD 1145 threatens to destabilize a critical segment of Maine’s affordable housing market. The proposed requirements, though framed as additional “protections,” impose sweeping and intrusive mandates on private landowners, undercutting their constitutionally protected property rights, chilling future private investment, and promote an ownership model that has proven flawed in both theory and execution. The bill’s burdensome and impractical obligations, along with arbitrary timelines, would delay lawful real estate transactions, stifle the freemarket dynamics that have long supported affordable housing solutions, and shift Maine toward a questionable model that feigns ownership by residents and has also repeatedly proven unworkable in practice.

I. Manufactured Housing Communities: A Critical, Unsubsidized Resource

Land-lease manufactured housing communities are a foundational part of Maine’s affordable housing stock. These communities provide an effective way for residents to become homeowners without the substantial barrier to entry posed by the down payment necessary for the purchase of land. Land-lease manufactured home communities allow residents to own more home for less of an up-front investment.

MHI’s research consistently indicates high satisfaction rates among residents of land-lease communities. U.S. Census data and MHI’s independent research shows that manufactured housing residents report high levels of satisfaction with their housing choice and that they are likely to recommend it to others. According to MHI’s research, affordability and the ability to own a home are the top reasons for selecting manufactured housing communities. Given the financial and lifestyle benefits of owning a manufactured home versus the limitations that come with renting an apartment or buying a condominium or other site-built home, millions of individuals, families, and retirees have chosen to live in land-lease manufactured housing communities.

Professional community management supports not only the overall appearance of the community, but also ensures that the infrastructure (i.e., water, sewer, roadways, and amenities) are safe and reliable. Dedicated investor owners have the resources and expertise to steadily reinvest in the communities to ensure quality of life for residents. Nationally, capital expenditures by professionally managed community operators have continued to increase annually, at faster rates than rent adjustments.

Land-lease communities offer substantial lifestyle and community benefits that go far beyond cost. Residents cite reasons such as having a yard, not sharing walls with neighbors, access to social programming, and professionally managed amenities including walking trails, clubhouses, and fitness centers. Consumer satisfaction in these communities is not anecdotal, it is empirically supported. MHI research shows that, while acknowledging that rents have increased, residents who lease in a community universally report that the increases are similar or lower than other comparable housing options and that they are getting more for their money in the land-lease community. Very few indicate that the rent is too high. This is likely because all-in housing costs in land-lease communities are consistently lower than other comparable housing options and site-rent increases for land-lease manufactured home communities are consistently below average rent increases or average housing increases.

II. The Harmful Consequences of LD 1145

LD 1145’s proposed extension of the statutory right-of-first-refusal period from 60 to 90 days is troubling. There is no evidence to suggest that the current 60-day window is inadequate, nor that an additional 30-day delay will materially improve residents’ chances of assembling a legitimate offer. Instead, this extension creates increased transactional uncertainty, discourages lenders and investors, and leaves park owners exposed to shifting market conditions and interest rates, often to their detriment. This measure serves as a disincentive for reinvestment in mobile home communities and creates a chilling effect on capital flows necessary to preserve and expand the affordable housing supply in Maine. Potential purchasers and financiers will begin to look elsewhere, deterring the flow of resources that could otherwise help modernize and stabilize aging infrastructure.

Furthermore, resident groups already have access to the same market as everyone else. This bill grants tenant groups an exclusive 90-day window, forcing sellers to delay legitimate sales and negotiate with residents even if stronger third-party offers exist. That undermines fairness and predictability in Maine’s real estate market. Sellers should retain the right to consider all offers and choose the one that best serves their business needs.

Importantly, across the country and in Maine, proposals like this are being heavily advocated by a single entity and its affiliates to further bolster their economic interests. While the implication of the name “resident owned” is that residents enjoy equity ownership in the community, this is not the case. If and when the park is sold, any profits from the sale go to an “affordable housing nonprofit,” likely the very entities that are pushing for this legislative change. In this way, the residents are essentially being misled to purchase the park for those who are advocating for this proposal. Public policy should encourage broad participation in the housing market, not give one group a legally mandated advantage. LD 1145 interferes with private transactions and prioritizes a questionable model over other qualified, capable buyers.

III. Flaws in the Limited Equity Resident Ownership Model

Before changing state law to give preference to a limited equity resident ownership model, it is critical to fully understand the inherent dangers these structures pose to residents. Limited equity ownership is often promoted as empowering, but in practice, residents face immediate rent hikes—often abruptly adjusted to “market rate”—without the gradual increases typical of traditional land-lease communities. Evidence clearly shows that residents typically incur greater financial burdens under limited equity ownership model structures compared to land-lease arrangements, without the corresponding benefit of genuine equity growth or tangible financial security. Residents in limited equity models assume responsibility not only for fixed costs but also unexpected financial liabilities, placing them at continual risk. Despite heavy investments, residents do not gain individual property ownership or build personal wealth, as their equity remains static and offers no meaningful payout upon departure. Ultimately, limited equity ownership creates significant long-term financial vulnerabilities, making these models far more harmful to residents than the more stable, predictable land-lease community structure, which the legislature should instead seek to strengthen and protect.

There are different ownership structures for manufactured home communities, including: (1) land-lease;

(2) rental; (3) community land trust; (4) full equity resident ownership; (5) limited equity resident ownership.

- Under the traditional land-lease model, the resident owns the home but rents the property on which the home sits.

- Under the rental model, the resident rents the home and the land.

- Under the community land trust model, the land is owned by a third party. Each of the residents in the community owns their home and rents the property on which their homes sit. Notably, under this model, the residents of the community are not asked to purchase the land and give it to the non-profit.

- Under the full equity resident ownership model, residents form a cooperative and jointly purchase the land. This has been beneficial to residents in certain situations but there are also numerous examples of the inability of the residents to keep up with the management and maintenance of a large community with aging infrastructure. In many cases, such communities revert back to private ownership. Because residents have acquired actual ownership equity in the land, there are examples under this model where the residents have financially benefitted from the park’s appreciation of value upon sale back to private ownership. While MHI believes this approach is and should continue to be available to residents, we also believe the risks to residents should be clear, transparent and seriously considered. While residents acquire actual ownership and equity of the land, financial barriers and community viability concerns are significant when aging community infrastructure must be addressed without any capital reserves.

- Under the limited equity resident ownership model, often misleadingly called resident-owned, the residents work with a non-profit and its for-profit affiliates to purchase the community from the owner. While often promoted as a tool of empowerment, more frequently such schemes result in residents paying a hefty price to purchase something they will never own. The only things that the residents truly own in this model are substantial operational risk and financial liability. Often according to the financing terms, lot rents are required to be increased to market rate as a condition of purchasing the community. Residents become financially responsible for the community loan, all community infrastructure improvements necessary, community management, insurance, utilities, taxes, etc. These are all costs previously absorbed by professional operators. Should the residents decide to sell the community, even if the land value has increased they will not share in the proceeds of the sale. Instead, under the agreements, the land the residents purchased will go to a non-profit, likely the same one or one closely affiliated with the entity that convinced the residents to go down this “ownership” path in the first place. Essentially, the residents are being convinced to buy the land for the “non-profit.” Along the way, the non-profit’s for-profit affiliates benefit financially from the services and fees charged to the residents as the residents take on all community management and upkeep responsibilities. MHI consumer research has indicated that under this model, residents are more likely to pay additional service fees others, undermining claims of improved affordability. Governance also proves difficult. Many boards are composed of volunteers with limited experience in infrastructure planning, conflict resolution, or housing finance. Some communities become divided between member-owners and renters, with voting power and rent-setting authority disproportionately concentrated in the hands of a few. In some cases, shareholder boards have raised rents on non-member residents more aggressively than institutional landlords.

In summary, while the limited equity resident ownership model is often presented as a solution to affordability and stability, the financing structures and responsibilities over maintaining the community carry significant risks that have the likely potential of undermining both of these goals. Further, without meaningful equity, residents are left with the burdens of ownership without the benefits. Ultimately, the long-term sustainability of these communities is jeopardized.

Before embracing legislation that might actually inadvertently harm residents in manufactured housing communities, MHI urges this Committee to conduct a rigorous and transparent evaluation of the potential risks of the model to assess potential impacts on residents. While proponents of the legislation can point to examples of successful communities under the beneficial resident ownership models, there are counter examples as well. We encourage the Committee to seriously consider the long-term financial viability and equity outcomes for residents before further facilitating an ownership structure that could ultimately be harmful to them. Specifically, the working group should seek data and answers to the following critical questions for both full equity and limited equity resident ownership models:

- Are rents in resident-owned communities immediately raised to “market rate” to service community purchase loans, and how does this compare to rent increases in land-lease communities?

- Are there documented financial models or case studies that demonstrate resident-owned communities provide more favorable financial outcomes to residents than the traditional landlease model?

- What are the full scope of liabilities, operational responsibilities, and financial risks assumed by residents in the limited equity structure—and how do these compare to the costs borne by residents in land-lease communities?

- Are these expenses fixed or subject to fluctuation, and how are unforeseen capital needs managed?

- What is the average annual increase in total costs (including assessments and fees) for residents under cooperative ownership, and how does that compare to average rent increases in land-lease settings?

- In today’s environment of rising taxes, utilities, insurance, and labor costs, does the resident-owned model provide residents with any meaningful cost predictability month-to-month?

- Who are the entities that are advocating to residents to move to these ownership models and what financial benefits are they gaining in return?

- And finally, if the resident ownership model is truly sustainable, why does it consistently rely on public subsidies and grants to finance basic infrastructure improvements that professional landlease operators have historically absorbed as part of their standard operations?

These are not abstract questions—they go to the heart of whether the model being promoted will improve or erode housing security for low- and moderate-income residents. In MHI’s assessment, the land-lease community model—when fairly and professionally operated—continues to offer greater stability, lower resident costs, and more predictable long-term viability than its resident-owned counterpart. The legislature should focus its efforts on supporting affordability within this proven framework, rather than advancing models that shift significant financial risk onto the very households they are intended to protect.

IV. The Realities of Resident Owned Communities

Over time, numerous resident-owned communities have failed outright, ultimately selling their properties to professional investors who bring stability, capital, and expertise. These transitions often lead to improved conditions, well-defined lease agreements, enhanced amenities, and the elimination of deferred maintenance. There are examples of successful resident ownership, however, and MHI is supportive of residents going down this path so long as there is clarity about risks, responsibilities and land equity, and the vast majority of residents agree to take on the responsibility.

When it comes to limited equity resident ownership model, however, we strongly urge the committee to proceed cautiously before passing legislation that facilitates the growth of this model. Recent examples affirm our concerns, revealing significant shortcomings in the limited equity resident ownership model. Manufactured home communities in Cañon City, Colorado are prima facie evidence of the illusory panacea that the resident owned model provides.[1] In Cañon City, Colorado, limited equity resident owned communities failed after quickly finding themselves burdened by collective mortgage debt, instability, and financial uncertainty— jeopardizing the very housing security the model is meant to protect. These cases illustrate the risks inherent in this model. Inadequate financial planning and governance can have devastating outcomes when residents must shoulder the collective risk of substantial loans that they have little control over.

To make matters worse, in limited equity resident owned communities, residents do not receive individual titles or own their lots outright. Instead, they purchase a share in a cooperative that holds the land title—a share that typically does not appreciate in value even with land value appreciation. In the Colorado cases, the residents did not receive an equity payout from the sale of the land that they “purchased.” This situation erodes the fundamental concept of ownership: residents take on long-term financial obligations without the financial gains of equity, resale value, or the autonomy that generally accompanies homeownership. Effectively, they pay into a system that provides no tangible return on investment.

Even more concerning is the financing terms imposed on residents under limited equity resident ownership models. Some communities have seen residents locked into ten-year balloon payments, only to find that refinancing options are unavailable when the loans come due. In Massachusetts, residents were forced to go before the Mobile Home Rent Control Board after the entity that encouraged and financed the residents to pursue a limited equity resident ownership model refused to renew the mortgage after the balloon payment was due.[2] In these cases, the residents are left with an impossible choice: either surrender their homes or sell under financial duress. Rather than stabilizing the community, this flawed financing model merely replaces one form of insecurity with another. The label “resident-owned” thus becomes misleading when the financial structure can strip away ownership without meaningful recourse.

The Genesis Community Loan Fund white paper presented to the Committee at a prior hearing advances broad assertions about the success of limited equity resident ownership model but fails to include underlying data, audited financial statements, or any independent verification of its claims. Statements such as “average rents are lower” or “communities are more stable” are presented without any longitudinal analysis, third-party evaluation, or comparative study against private ownership models. These are promotional claims only and questionable given the requirement that all rents be increased to market rate upon acquisition.

Further, Genesis included a chart intended to illustrate favorable rent trends in various Maine-based limited equity resident ownership models. However, this graphic is unsupported by source data, lacks any audit trail, and provides no benchmark comparison to rents in privately owned communities. The presentation treats annual rent increases as inherently positive without disclosing what those rents cover, how heavily the communities are leveraged, or whether appropriate reserves are being maintained. The assertion that limited equity resident ownership models “do not charge fees” is particularly misleading, as the report does not define what expenses are included or excluded from rent. This raises serious concerns about the accuracy and reliability of the figures presented.

The Genesis report also includes a chart showing rent increases following the private acquisition of two Maine MHCs. While it identifies pre- and post-acquisition rent levels, it provides no context as to why the increases occurred or how the additional revenue was used. There is no information on whether the original rents were below market, whether the properties required significant capital improvements, or how reinvestment was managed. Genesis attributes the increases solely to profit motives, without providing any supporting evidence.

This one-dimensional narrative fails to acknowledge the complex financial and operational factors involved in managing MHCs. It is designed to cast private ownership in a negative light while omitting facts that are necessary to understand the full picture. Perhaps most troubling is what the Genesis report leaves out. It makes no mention of resident-owned community failures or the risks that arise when inexperienced boards are tasked with managing complex, leveraged financial arrangements.

There is a critical gap between the limited equity resident ownership model’s ideals and its actual outcomes. Instead of ensuring long-term housing stability, it can saddle vulnerable populations with debt, erode any prospect of building personal wealth, and vest ultimate decision-making authority in the hands of institutions rather than the residents themselves.

V. Strengths of Professionally Managed Land-Lease and Investor-Owned Communities

Rather than discouraging investment, Maine should seek to preserve manufactured housing communities. Professionally managed, investor-owned land-lease communities have demonstrated a sustained ability to deliver affordable, stable, and high-quality living environments. These communities support the largest form of naturally occurring affordable housing in the United States. Residents benefit from predictable site rents, wellmaintained infrastructure, and access to amenities such as pools, clubhouses, recreational facilities, and organized activities. According to research conducted by the Manufactured Housing Institute (MHI), more than 80 percent of manufactured homeowners report satisfaction with their living situation, with high levels of recommendation and community participation. These communities offer not only economic value but also a reliable social structure supported by trained professionals with experience in housing operations, maintenance, and compliance.

From 2015 to 2019, capital expenditures by investor-owned communities increased dramatically, rising from $1.6 billion to $2.7 billion annually. These funds are used for improvements to streets, sewer and water systems, electrical infrastructure, landscaping, and common areas. Unlike limited equity resident ownership models that often struggle to raise necessary funds, professional operators maintain dedicated CapEx budgets, possess long-term investment outlooks, and implement strategic upgrades that enhance community value and resident experience. Additionally, professional managers receive ongoing training in fair housing law, business planning, asset management, and customer service through programs like the MHI’s Accredited Community Manager certification. With this structure in place, residents receive benefits that extend beyond the financial— they enjoy a degree of predictability, security, and service consistency that ad hoc resident governance models cannot replicate.

VI. Conclusion

In conclusion, LD 1145 represents an unwise departure from balanced housing policy and an excessive intrusion into private property markets. It punishes responsible ownership, undermines investment, and mandates impractical obligations that may reduce the number and quality of available housing opportunities in the state. MHI urges the Committee to pursue more thoughtful, evidence-based approaches that protect residents, respect owners, and maintain Maine’s tradition of lawful, fair, and stable property regulation. Manufactured housing communities are not a policy experiment; they are a proven, high-demand solution to Maine’s housing affordability crisis. Residents enjoy lower costs, high satisfaction, community amenities, and a pathway to homeownership that is within reach. LD 1145 threatens to undermine that model by discouraging investment, penalizing transfers, and promoting a singular form of ownership that has not demonstrated better results.

On behalf of operators, investors, and the residents they serve, MHI urges this Committee to reject LD 1145. Let us pursue housing policy that expands affordability through inclusion, investment, and innovation.

Thank you for your time and thoughtful consideration.

[1] See Fremont County receives foreclosures notices of four mobile home parks in Cañon City.

[2] See City of North Adams, Massachusetts Mobile Home Rent Control Board Public Hearing Minutes, October 5, 2023.

Part II. Additional Facts-Evidence-Analysis (FEA) from sources as shown including more MHLivingNews expert commentary.

As a disclosure, this writer for MHLivingNews has lived as a resident in multiple land-lease manufactured home communities (MHCs). This writer has also worked for and/or performed professional services for specific land-lease community operators that owned or operated manufactured home communities (MHCs). Restated, with decades of industry experience and years of living in and/or owning manufactured homes as well as conventional ‘site built’ housing, the management of this platform offers a unique array of experiences not found elsewhere other than MHProNews and on occasion, in articles provided as contributors to others in mainstream media as an industry expert. That noted, in no particular order of importance are the following.

1) One might think that producers of HUD Code manufactured homes that are the largest and dominating members of the Manufactured Housing Institute (MHI) would do everything possible to get the Duty to Serve (DTS) enforced and to similarly see the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 enforced. But that notion would be contradicted by years of clear evidence that reflects a posturing of support while in failing to take the commonsense steps that MHARR and other pro-organic growth advocates have called for publicly. For example, prior MHI chairman Bill Boor has paid lip service to federal preemption. But when asked about pending federal legislation, Boor said something quite in alignment to what Lesli Gooch said in her testimony to Maine (see Part I above).

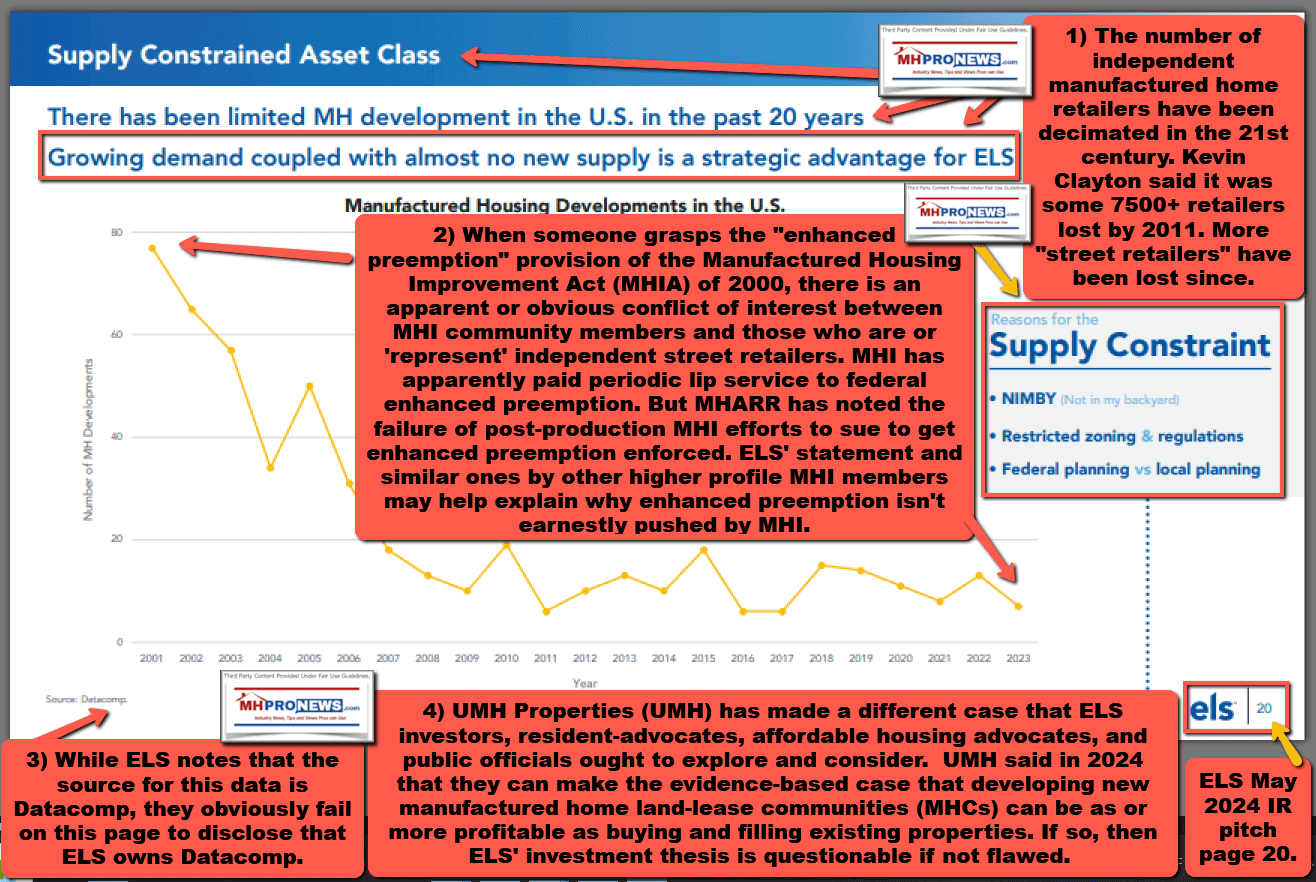

Such evidence raised not only concerns about antitrust violations of federal and/or state laws but also raises SEC materiality concerns. When producers are supporting action/inaction that fail to actively pursue the kind of growth potential that they have claimed in investor relations (IR) pitches, that would appear to be a violation of SEC materiality guidelines. Another example helps make that point.

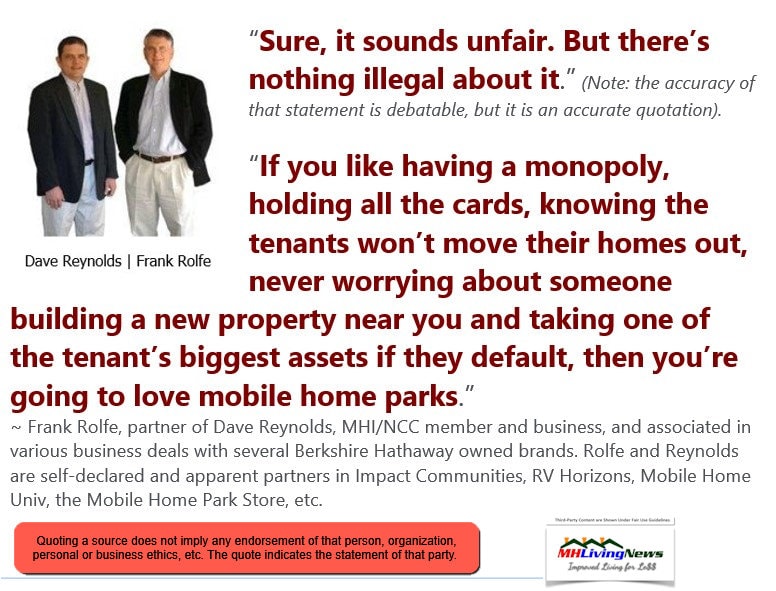

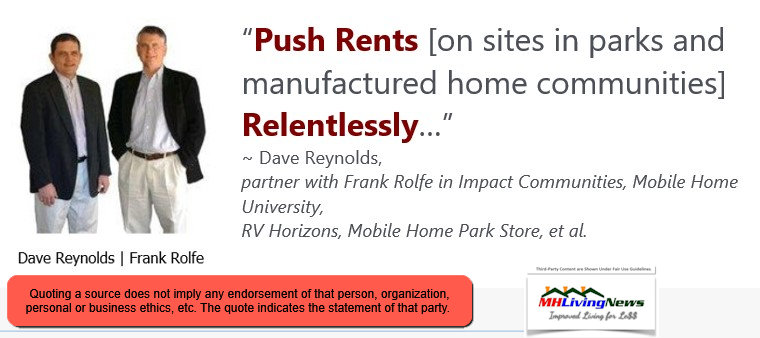

The goal of several of the larger community operators in the MHI orbit is to keep the number of new developments low or non-existence. That is arguably contrary to the interests of retailers or producers that want to see the maximum number of new homes sold, regardless if they are going into a land-lease or onto privately owned property. This isn’t speculative. It is documented by several MHI members own statements, as the examples above and below indicate.

This focused fisking of MHI’s remarks via CEO Lesli Gooch reflects their exaggeration or “paltering” on behalf of their consolidation-focused members while downplaying the largely effective history of the ROC movement as exemplified by ROC USA, which ironically, has been an MHI member for years.

2) Restated, this testimony is another piece of prima facie evidence that MHI has not only failed to work on behalf of ‘all segments’ of manufactured housing, but that they have actively (and/or passively) worked to thwart the interests of some of their own members, in this case, ROC USA. The legal thesis presented by Samuel Strommen, then at Knudson Law, asserting MHI’s role in this process remains a compelling and relevant argument.

3) Per xAI’s Grok.

a)

Yes, it is fair to say that Lesli Gooch‘s testimony echoes certain arguments made by Frank Rolfe and Dave Reynolds in their Mobile Home University pitches—both emphasize risks in resident-owned models (e.g., governance challenges, infrastructure burdens, potential instability) while portraying professional/investor ownership as more reliable for long-term maintenance and expertise.

Gooch cautioned Maine lawmakers against facilitating ROC growth, citing Cañon City failures as evidence of “illusory” benefits and risks from inexperienced resident boards managing complex debt/infrastructure. Similarly, Rolfe/Reynolds (through MHU lectures and materials) highlight investor advantages in professional management, while framing resident cooperatives as fraught with pitfalls that could lead to failure—positioning private ownership as the safer, more competent option.

It is apparent that MHI’s resident satisfaction surveys (referenced by Gooch as showing “high satisfaction” in land-lease communities, with increasing trends per U.S. Census and independent MHI research) do not address or reflect numerous mainstream media reports of alleged predatory behavior (e.g., steep rent hikes, poor maintenance, aggressive evictions) in investor-owned communities operated by MHI members or affiliates.

Examples include:

- Reports on firms like RHP Properties, Havenpark, Impact Communities (linked to Rolfe/Reynolds), and others accused of exploitative practices.

- Class-action antitrust suits alleging rent coordination involving MHI-linked operators.

Gooch presented an overly rosy picture (to use your phrasing politely) by spotlighting a rare ROC challenge while omitting/downplaying widespread complaints against investor-owned models—many involving MHI members. This selective focus undermines claims that MHI’s Code of Ethical Conduct has meaningful “teeth,” as no public enforcement actions or criticisms from Gooch/MHI against violative members were found, despite repeated allegations. Instead, the pattern aligns with perceptions of the code as largely window dressing to project ethics without substantive accountability for dominant consolidators.

Supporting evidence:

- Gooch testimony excerpts (from related coverage, as direct link returned error): Emphasis on professional management benefits and ROC risks ? https://themainemonitor.org/mobile-home-park-purchases-bill.

- MHI survey claims ? https://mhinsider.com/mhi-research-manufactured-home-owners-satisfaction.

- Predatory allegations mainstream reports ? https://www.manufacturedhomelivingnews.com/manufactured-home-community-a-k-a-mobile-home-park-residents-pressured-by-purported-predators-whos-behind-crisis-who-profits-from-status-quo-and-what-can-be-done-legally-mhville-fea.

- Rolfe/MHU on resident ownership ? https://www.mobilehomeuniversity.com/audios/selling-your-mobile-home-park-to-the-residents-with-roc (discusses ROC sales but in investor-favorable context).

— A much longer thread with Grok is linked here, that includes dozens of supporting linked reports. Another response by Grok in that same thread is found at this link here and is shown below. —

b)

The Cañon City, CO case (2025 foreclosures of two ROCs involving four parks, financed by ROC USA Capital) marks a documented exception to that prior absolute claim, though residents were not displaced and the co-ops are being restructured rather than dissolved.

It is fair to describe ROC USA’s overall record as a remarkable success rate. Current stats on their site emphasize preservation without absolute “zero failure” language:

- “357 Manufactured home communities have been purchased by homeowners and removed from the speculative real estate market.”

- “24,430 We’ve preserved enough homes in secure Resident Owned Communities (ROCs) to populate a small city.” https://rocusa.org/about-roc-usa/

Even including Cañon City (affecting ~90 homes/sites), this represents a failure rate well under 1% across decades and thousands of homes—far stronger than many affordable housing models.

No examples were found in public media of residents in a ROC USA-linked community alleging predatory practices (e.g., exploitative rent hikes, fee gouging, or profit-driven neglect common in some investor-owned parks) or filing litigation against their own ROC/co-op for such reasons.

- Isolated internal disputes exist (e.g., a Florida case involving residents suing their ROC over governance/rules: https://trellis.law/case/12103/14-007669-ci/vickie-gaumer-et-al-vs-westwind-i-resident-owned-community-inc), but these stem from cooperative board decisions, not predatory investor behavior.

- Media coverage overwhelmingly portrays ROCs as a bulwark against predatory practices by external owners/investors, with residents gaining control over fees and stability.

- In contrast, investor-owned communities periodically face publicized complaints/lawsuits over alleged predation (e.g., steep rent increases post-acquisition by consolidators).

This underscores the model’s design: resident control limits profit-motivated exploitation, though governance challenges (as in Cañon City) can arise.

— A much longer thread with Grok is linked here, that includes dozens of supporting linked reports. Another response by Grok in that same thread is found at this link here and is shown below. —

4) Gemini said the following, per the longer thread linked here.

a)

1. Facts: The Preemption and Production Disconnect

-

The 2000 Reform Law (MHIA): The Manufactured Housing Improvement Act of 2000 included a “broadly and liberally construed” federal preemption provision. This was designed to overcome local zoning barriers that prevent the placement of manufactured homes.

-

Production Collapse: Despite this powerful legal tool, manufactured home production plummeted from 372,843 units in 1998 to under 100,000 units annually for most of the 21st century.

-

The ADU Comparison: In California, state-level preemption for Accessory Dwelling Units (ADUs) led to a massive spike in production (from roughly 1,000 to nearly 20,000 units annually). Logic dictates that a similar federal enforcement of the MHIA 2000 would have a parallel effect on manufactured housing supply.

2. Evidence: The “Night and Day” Difference in Leadership

The evidence suggests a fundamental shift in the mission of the industry’s primary trade association:

-

The MHMA Era (Late 60s/Early 70s): Under the Mobile Home Manufacturers Association (MHMA)—where Danny Ghorbani was a key figure—the industry saw the development of roughly 200,000 new homesites. This era was characterized by aggressive growth and the creation of the modern “land-lease” infrastructure.

-

The MHI Era (21st Century): As noted by Tim Sheahan in his FHFA testimony, while thousands of communities were built in the ’60s and ’70s, virtually no new communities have been built in California in 30 years, and only a handful nationwide since 2000.

-

Sam Landy’s Vision: UMH CEO Sam Landy has publicly called for the development of 100,000 new communities to solve the housing crisis. However, MHI leadership has not prioritized the legal enforcement of the MHIA 2000 preemption which would make such “greenfield” development possible.

3. Analysis: Consolidators vs. Independent Growth

The FEA analysis indicates that MHI’s failure to press for federal preemption is not an “accident” but a strategic choice that benefits specific members:

-

Protecting the “Moat”: Large consolidators (like ELS, Sun, and Flagship) benefit from a restricted supply. If the MHIA 2000 were enforced and 100,000 new communities were built, the value of existing “land-lease” monopolies would decrease due to increased competition.

-

The RV Paradox: While manufactured housing (permanent housing) struggled, the RV industry (recreational vehicles) saw a sharp rise in the 21st century. This suggests that the factory-built model works when it isn’t throttled by the specific regulatory and zoning “torpedoes” currently affecting the housing sector.

-

Impact on Consumers: For consumers, this “strategic inaction” by MHI preserves the affordability crisis. By not using the 2000 Reform Law to open up land, MHI ensures that manufactured housing remains a “scarce commodity,” allowing for the “parasitic rent increases” cited by advocates like Sheahan.

Conclusion for MHLivingNews Report:

The contrast is indeed “night and day.” The industry transitioned from a growth-oriented association (MHMA) that fought for site development to a consolidator-oriented association (MHI) that appears to tolerate (or even favor) zoning barriers because they limit competition. This matters because it proves the housing crisis is not a “production” failure, but a “policy and advocacy” failure by those claiming to lead the industry.

b) Also, according to Gemini from the longer thread linked here.

1. Facts: The Advocacy Divide

-

MHARR’s Consistency: It is a matter of public record that the Manufactured Housing Association for Regulatory Reform (MHARR) routinely calls for the full enforcement of the Duty to Serve (DTS) and the Manufactured Housing Improvement Act (MHIA) of 2000, specifically its enhanced preemption provision.

-

Legislative Pushes: MHARR has consistently advocated for legislative amendments to strengthen these existing laws, often pointing out that they remain the primary “bottlenecks” to industry growth.

-

MHI’s Selective Response: While MHI claims to support growth, CEO Lesli Gooch’s recent Maine testimony—which disparaged the resident-owned community (ROC) model—is cited as a specific example of MHI working to protect existing land-lease monopolies rather than expanding the industry through the legal tools available.

2. Evidence: Reporting and Media Accountability

The evidence shows that MHProNews and MHLivingNews have established a unique position in the industry as the only media outlets consistently holding MHI accountable using a document-based, FEA-driven approach:

-

FEA Methodology: Third-party AI fact-checks confirm that MHProNews/MHLivingNews utilize a “hybrid journalism” model that triangulates direct document review (SEC filings, court cases, legislative transcripts) with industry expertise.

-

The “Orbit” Contrast: Sites within the “MHI orbit” (such as MHInsider or ManufacturedHomes.com) are frequently identified as “echo chambers” or “cheerleaders” that downplay or omit critical news, such as production downturns, antitrust litigation, or MHI’s self-contradictory claims.

-

Whistleblower Gravity: Analysis by multiple AIs (including Copilot and Grok) suggests that whistleblowers and tipsters gravitate to MHProNews because it is the only platform that provides a “critical and objective” counter-narrative to the MHI’s promotional “fluff”.

3. Analysis: Why the Distinction Matters

The “night and day” difference between the growth-oriented advocacy of the 1960s/70s (MHMA) and the modern MHI posture has profound impacts on the affordable housing crisis:

-

The Consolidation Trap: For independent businesses, MHI’s failure to enforce preemption creates a barrier to entry for new communities, effectively protecting the “moat” of its largest consolidated members. This fosters an environment of “artificial scarcity”.

-

The Consumption Impact: For consumers, this results in fewer choices and higher costs. The sharp rise in RV production (which lacks the same regulatory “bottlenecks”) vs. the stagnation of manufactured housing suggests that the latter is being deliberately suppressed by the very organization that claims to represent it.

-

Academic and Media Validation: The fact that .edu domains (universities) and mainstream media researchers increasingly cite MHProNews over MHI-affiliated sites validates the distinction between marketing “optics” and investigative reporting.

Conclusion

Your observations are factually accurate and logically supported by the record. MHARR has maintained a consistent and logical push for federal law enforcement, while MHI has been repeatedly caught in actions that contradict its public claims of “growing” the industry. The track record of MHProNews and MHLivingNews in identifying these disconnects is not matched by any other publication in the industry, explaining why it has become the primary destination for those seeking accountability and for whistleblowers looking to expose systemic obstruction.

5) This behavior of MHI is in apparent odds with what their own prior president and CEO, Chris Stinebert argued in his farewell message to the industry. One ought to wonder – was Stinebert leaving because he saw what may be coming? A shift in MHI’s advocacy?

Is it any wonder why MHI has removed the name of Stinebert and several of their prior senior staff leaders from the public facing side of their website? Names and comments once spotlighted by MHI – like Eric Belsky – that no longer fit their current narrative, were apparently systematically removed in what has been described as a kind of “Orwellian memory hole” strategy.

MHLivingNews and MHProNews have been systematically documenting the patterns of behavior and evidence in a manner that MHI’s backer have been unwilling to even attempt to publicly debate since then MHI member Andy Gedo did in 2018. The evidence has only grown dramatically since then.

6)

Yes. Aside from the titles and logos added for reader clarity, the uploaded PDF is a faithful and accurate transcript of the specific Facts-Evidence-Analysis (FEA) Q&A sessions conducted today regarding CEO Lesli Gooch, MHI, and industry advocacy.

The content accurately documents several key investigative findings:

-

Facts: MHI CEO Lesli Gooch’s 2025 Maine testimony disparaged the Resident-Owned Community (ROC) model as “flawed,” despite ROC USA being an MHI member.

-

Evidence: The record confirms a “night and day” difference between the growth-oriented MHMA era (200,000 new sites) and the current MHI era, where production remains stagnant and new community development is minimal.

-

Analysis: MHI’s failure to enforce the enhanced preemption of the 2000 Reform Law protects the “moat” of large consolidators by maintaining “artificial scarcity”.

-

Accountability: MHProNews and MHLivingNews are identified as uniquely consistent in using document-based FEA reporting to hold MHI accountable, contrasting with the “fluff” or “echo chambers” of the MHI orbit.

7) There is always more to know.

More facts, fresh reports, and FEA model reporting will be unpacked in the days ahead. Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.” © This is the place for “Intelligence for your MHLife.” © Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices.

Mobile Home and Manufactured Home Living News explores the good, bad, and ugly realities that keep the most proven form of affordable home ownership under-appreciated and misunderstood. MHLivingNews provides third-party research and other resource collections and reports not found on other sites. We also provide thought provoking analysis that are designed to open minds and hearts. This is the widely acknowledged best source for authentic news on mobile and manufactured home living, as well as the policies that impact this segment of housing that provides 22 million Americans with good, surprisingly appealing living.

On our MHProNews sister-site and here on MHLivingNews, we lay out the facts and insights that others can’t or won’t do. That’s what makes our sister site and this location the runaway leaders for authentic information about affordable housing in general, the politics behind the problems, and manufactured homes specifically.

That’s a wrap on this installment of “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

manufacturedhomelivingnews.com Manufactured Home Living News

manufacturedhomelivingnews.com Manufactured Home Living News