Why is there so little competition in the manufactured home lending market? While there are several interlocking factors, one of the simplest points to make is that the mortgage giants Fannie Mae and Freddie Mac are not doing the robust lending in the manufactured home market as they are doing for conventional housing. What follows is a step-by-step explanation based upon the law, official government statements, and various expert comments that all relate to this topic. This Mobile and Manufactured Home Living News (MHLivingNews) report and analysis will explain the current dilemma, its causes and the possible cures. As a teaser, on paper, the remedy is remarkably easy. They could be summed up like this. There are already several laws on the books that each aim to provide more lending, and at more competitive rates, than are currently available. Other laws also exist that would benefit manufactured housing. Those laws were widely passed by bipartisan legislation. Yet they are not being properly enforced. How is that possible? We will explore that and related questions. Because understanding how to get more competitive lending for manufactured housing, background information is necessary. Once the facts are understood, once the laws are understood, then the next steps on getting more competitive lending can become easier. Because it all comes down to this. Properly enforce existing laws.

With that introduction, let’s dive in using our normal step-by-step process.

Let’s start with some facts from the federal government. Per the FHFA website: “Fannie Mae and Freddie Mac were created by Congress. They perform an important role in the nation’s housing finance system – to provide liquidity, stability and affordability to the mortgage market. They provide liquidity (ready access to funds on reasonable terms) to the thousands of banks, savings and loans, and mortgage companies that make loans to finance housing.

Fannie Mae and Freddie Mac buy mortgages from lenders and either hold these mortgages in their portfolios or package the loans into mortgage-backed securities (MBS) that may be sold.”

Hmm, okay. That’s accurate enough.

The FHFA further explains that: “By packaging mortgages into MBS and guaranteeing the timely payment of principal and interest on the underlying mortgages, Fannie Mae and Freddie Mac attract to the secondary mortgage market investors who might not otherwise invest in mortgages, thereby expanding the pool of funds available for housing. That makes the secondary mortgage market more liquid and helps lower the interest rates paid by homeowners and other mortgage borrowers.” If that doesn’t make sense the first time you read it, do an online search on what is confusing, and then return to this report. Because this is a roadmap for more lending, and understanding these details are useful and necessary.

The FHFA also says that besides their “effective supervision, regulation, and housing mission oversight” of Fannie and Freddie, they also regulate “the Federal Home Loan Bank System, which includes the 11 Federal Home Loan Banks (FHLBanks) and the Office of Finance. Since 2008, FHFA has also served as conservator of Fannie Mae and Freddie Mac.”

Fannie and Freddie, known as Government Sponsored Enterprises, GSEs, or “the Enterprises.” The Federal Housing Finance Agency (FHFA) is responsible for regulating the GSEs. Under the provisions of the Housing and Economic Recovery Act (HERA) of 2008, federal law mandated that Fannie and Freddie (GSEs) would facilitate a secondary market for manufactured homes, just as they do for conventional housing. That secondary market is what allows a lender to originate a loan, and then sell it off to investors. If you do not have a secondary market, that means that a lender must hold a loan ‘in portfolio,’ which means on a given lender’s own books.

Let’s sum up to this point. To oversimplify, in finance, when a lender makes a loan they either keep that loan on their own books, or they sell it off to the secondary market. The GSEs of Fannie and Freddie are the common tool used by lenders to access that secondary mortgage/finance market. FHFA is their regulator.

When loans can be sold off as investments, they often attract a lower interest rate. That is true for site built housing as well as manufactured homes.

Next, in her recent prepared remarks, the FHFA’s new interim director – Sandra Thompson – said the following.

Public Remarks as Prepared for Delivery

Sandra L. Thompson

Acting Director, Federal Housing Finance Agency

FHFA Virtual Listening Session: “Closing the Gap to Sustainable Homeownership”

Tuesday, June 29, 2021

I am honored by the President’s appointment and I am really looking forward to leading FHFA as we continue to carry out our Agency’s important mission.

Since I first joined FHFA in 2013, I’ve had the pleasure to work for four different directors and acting directors. Each built on the accomplishments of their predecessors, and I am looking forward to continuing that tradition.”

“…Today there is a widespread lack of affordable housing and access to credit, problems that are especially concentrated in communities of color.

FHFA plays a vital role in both promoting access to mortgage credit nationwide and protecting the safety and soundness of the housing finance system. We do this through our supervision of Fannie Mae, Freddie Mac, and the Federal Home Loan Bank System.” …

Thompson then makes a stunning admission, which she prefaced as follows.

“I served as the FDIC’s head of supervision throughout the most recent financial crisis. I witnessed firsthand the consequences of irresponsible lending when hundreds of banks across the country were closed and a record number of homes went into foreclosure.”

These bullets – quotes from her prepared comments – are the stunners:

-

- “I saw how the borrowers who received unsustainable loans and suspect loan products were devastated in the downturn. And Black and Latino communities were hit especially hard.

- Years of progress in closing the racial homeownership and wealth gaps were erased as a result. In fact, today the Black-white homeownership gap is wider than it was in the 1960s, when lending discrimination based on race was still legal.

- As a regulator, I know what expanding access to credit looks like. And I know what irresponsible lending looks like. Irresponsible lending is not an expansion of access to credit.”

So, Thompson admits that the rate of homeownership and the wealth gap have overall retreated since the 1960s. Clearly, much of what has been happening has not been effective.

That noted, Thompson is correct in saying that it is prudent to lend wisely. Because in the long run, it is harmful to lend money at terms and amounts that later ends up with a foreclosed or repossessed or repossessed home.

The last point for now from FHFA interim director Thompson statement above takes us a step closer to the point of this report.

“Today is an opportunity for us to hear from you about sustainably closing the homeownership gap. Your feedback will help FHFA ensure that our regulated entities equitably fulfill their mission and responsibilities.” ~ Sandra Thompson, acting FHFA director.

There are two immediate points to be made. For someone who sees this article prior to July 17, 2021 – you can submit written comments to the FHFA, urging more competitive lending NOW. As Laureen Boyd of the FHFA told MHLivingNews: “We will be accepting written comments through July 17” 2021.

You can submit your comments via the website page linked below. Let’s note that you do not have to use fancy words or cite a bunch of laws. You can simply tell your reasons and thinking in your own words.

That said, what follows may be useful to help you with facts useful in your comments.

However, if you are seeing this article on July 18, 2021 or later, there are still practical and legal things you can, should – or must –engage in to fix what has gone wrong in the manufactured home lending market. More on the post-July 18th timeframe later below.

The video that follows features Shark Tank star Kevin O’Leary. O’Leary is a multi-millionaire. In the video below, is is video interviewed during a cruise on a nice yacht. O’Leary begins by talking about commercial versus residential real estate. He comments in passing about COVID, vaccines, Amazon, etc. Let’s be clear, MHLivingNews is not endorsing all that is said in this video. In fact, it is broadly fair to say that when we quote any source that should not be deemed as an endorsement of all that a source said. A quote is a reflection of what the source cited said.

That noted, Stoic Finance’s narrator makes a fascinating point at about the 7 minute mark in this video. Properly understood, even though he is not talking about manufactured homes, what he says is highly relevant to our industry and to manufactured home buyers. This can be a fine time for many more affordable manufactured home. Keep in mind that the housing crash of 2007-2008-2009 was not caused by manufactured homes. Rather, the housing/finance crash was caused by problems with lending and capital markets as it related to overpriced conventional housing.

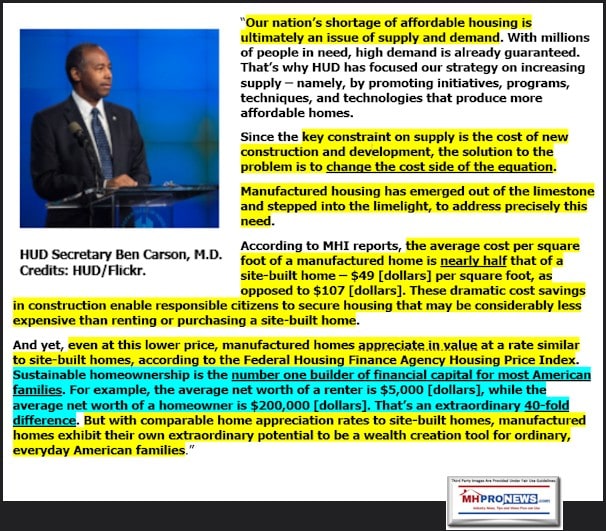

But competitive financing is a hurdle for more manufactured homes. The Urban Institute is among those who have said so. That noted, manufactured homes are still routinely a less costly way to own than buying conventionally built housing. While manufactured home payments may be higher than they normally would if lower rates were available, nevertheless, on total cost and on total payment, millions save money by buying a manufactured home. Needless to say, it would be better still for millions if the loans were less costly.

Who makes such points? How about the statements and takeaways from research by the National Association of Realtors (NAR)?

Part II – What The DTS Law Means, What’s Gone Wrong – More Info & Analysis

Now, comes the fascinating yet troubling part. By law, the GSEs of Fannie Mae and Freddie Mac are already required to make such loans. The FHFA video above makes that point. As the regulator, that means that FHFA is supposed to enforce the law. Oddly, these videos have had very few views. It is almost as if they are produced for almost no one to watch them. If you spend the money to produce a video, why didn’t the FHFA and Freddie Mac (Fannie has their version of this too) spend the money to market them and thus get people to watch these videos?

Hold that thought.

On March 25, 2021 – this writer – L. A. “Tony” Kovach – made comments shown further below to the FHFA. Those comments are also posted on the FHFA website at this link here. But before looking at those comments, let’s see what others have said, because it is eye opening.

Note that the Freddie Mac DTS program video above talks about and shows some video clips of manufactured homes. That said, it frankly ducks the issues raised in our prior report on this subject linked below. The comments then are from December 2019, but they are as applicable now as then.

With those notions and facts in mind about the law, its meaning, and what should be happening, we will then turn to what can and should be done to fix what’s wrong. That will be Part III of this report.

Note that while it is useful – in fact, encouraged! – that you make emailed or online/electronically posted comments that urge the FHFA to enforce existing laws. As of 3:58 AM ET, out of hundreds of millions of adult Americans, there are currently only 12 – one dozen – posted comments on the FHFA website on this topic.

So your comments, or that of someone you may know, could be more impactful. Because so few have sounded off, each comment can get more attention.

If those DTS laws were being fully and properly enforced, manufactured home loans would be less costly. Who says? Ironically, controversial Kevin Clayton of Clayton Homes, among others.

Despite this performance, the government sponsored enterprises (GSEs) have had little involvement and displayed little interest in financing and securitizing manufactured home loans. Less than one percent of GSE business comes from manufactured housing and none of that comes from manufactured home personal property loans.”

Tom Hodges, Clayton’s general counsel and also the current MHI chairman, said in subsequent federal remarks the following. “This barrier [caused by GSEs and FHA not creating a securitized path for more manufactured home lending] has effectively shut off the development of a viable secondary market for manufactured home loans leading to higher financing costs.”

Hodges then cited similar data as Kevin did.

What Hodges and Clayton said in those quotes are demonstrable true. They align with what the FHFA and others have said.

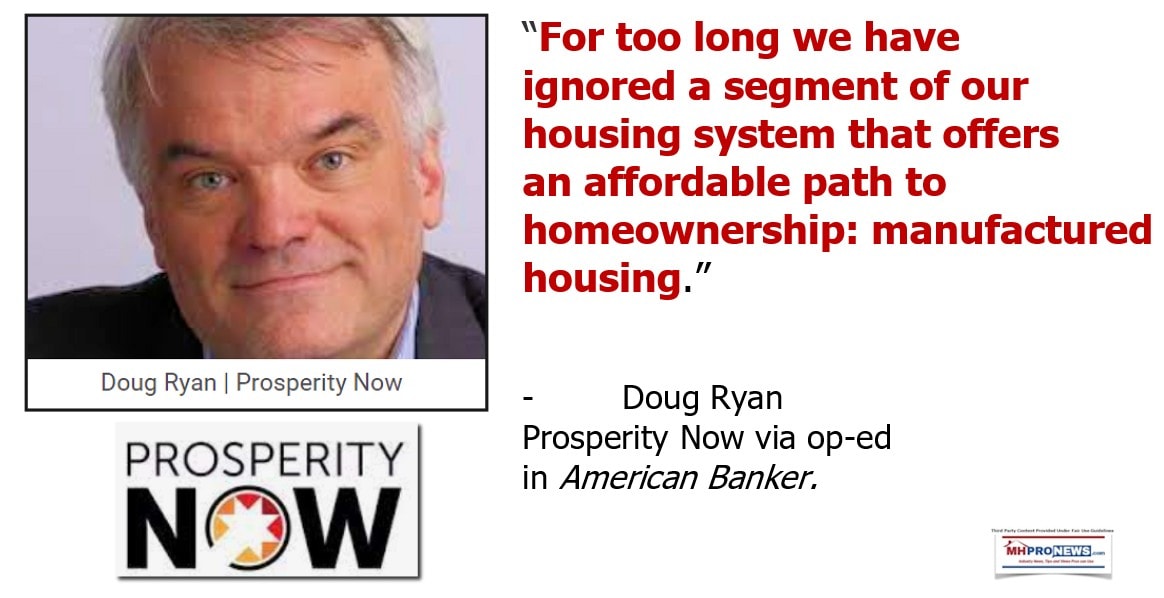

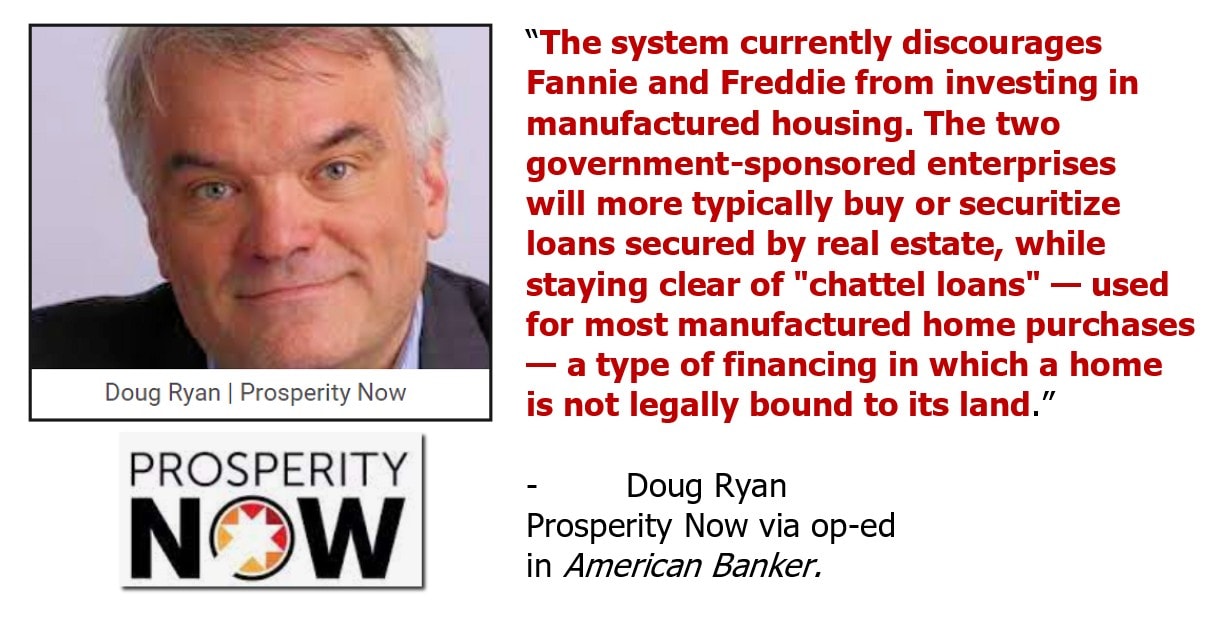

What is in question is did Clayton Homes and their affiliated lenders actually want that DTS lending to occur? Or where they merely posturing support for the DTS program? The evidence strongly suggests that Clayton and MHI have worked behind the scenes to say one thing, but accomplish another. Who says? How about pro-manufactured home, and pro-consumer advocate Doug Ryan, with Prosperity Now.

Simply put, the “system is rigged.” Who says? Several Democratic lawmakers, Doug Ryan, MHARR and others. Here is part of how Democratic lawmakers phrased the issue of Clayton Homes and their Berkshire Hathaway affiliated manufactured home lending.

As was noted above, Sandra Thompson, is the FHFA’s interim director. She is a Democrat. She’s been appointed by a Democrat. She says she is concerned with the wide gap between people of color and those with lower financial incomes accessing credit to buy homes sustainably. Why not put that to the test? Write the FHFA and challenge Thompson and her colleagues to do what they have said. Why not challenge them to enforce the law, even if Clayton and Berkshire Hathaway may not like it?

Don’t forget those thoughts and questions.

Next, let’s ponder CFPB insights on Clayton’s sister companies – 21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF) – as it relates to their lending, market share, etc. in manufactured housing is very relevant to this discussion.

Part III – Comments That Shed Light on Getting DTS Implemented

A well placed industry source has told MHProNews off-the-record the following. The following bullets will form, that source said, the core of their comments to the FHFA in DTS. The word “you’ve” below means Fannie Mae, Freddie Mac – and by implication – FHFA as their regulator.

- “(1) you’ve completely excluding chattel from DTS; (2) chattel is by far the predominate form of financing for the industry’s homes and especially for the industry’s most affordable homes; (3) you cannot possibly be in compliance with DTS within the manufactured housing market if you exclude chattel loans; and (4) stop lying to Congress about Fannie/Freddie’s alleged “compliance” with DTS and do what the law says.”

That is pretty succinct. If you ponder sharing comments, it could be that simple, plus your own words to encourage them to follow the law for the benefit of millions of people, including minorities, seniors, and those with limited or fixed incomes. That noted, the comments already posted on this topic can be viewed on the FHFA website at the link below.

https://www.fhfa.gov/PolicyProgramsResearch/Programs/Pages/DTS-ProposedPlanRFIList-2022-2024.aspx

Most of the current comments as of 3:58 AM ET 7.11.2021) are apparently modestly modified form letters from Manufactured Housing Institute (MHI) affiliates. While each are accurate to a point, they miss the stronger arguments that could be made. So, once again, it reflects what Doug Ryan and the MHEC members quoted below have said. But it also sheds light on what a state association leader, a member of the Manufactured Housing Executives Council (MHEC) said that was first quoted in 2018.

Against that backdrop, the next comments posted to the FHFA DTS comments page are from Ronald L. “Ron” Breymier, Executive Director of the Indiana Manufactured Housing Association (IMHA). But letters from other state executives such as Amy Bliss, Lance Latham, Tim Williams (OMHA), Ken Anderson, and other state association leaders which follow routinely use a very similar format and often the same or very similar phrasing. This is a strong clue that it is an MHI formatted response that each affiliate customized to fit their state.

Each bullet below is a pull quote from Breymier’s letter.

- Housing affordability impacts every community in Indiana. Manufactured housing can make a significant contribution to the production of affordable housing – moreover, it is affordable homeownership – the only naturally occurring affordable housing in America. Failing to provide adequate financing for these homes reduces the options for these prospective homebuyers.

- The 2022-2024 DTS Plans proposed by Fannie Mae and Freddie Mac represent a significant step backwards with respect to access to financing. The Plans include only modest, if any, increases per year for real property loans, and neither plan provides chattel loan financing – despite chattel loans representing the vast majority of manufactured home loans. In the proposed 2022-2024 DTS Plans for manufactured housing, Freddie Mac has abandoned the chattel loan effort completely and Fannie Mae only promises to “consider” the viability of a chattel loan pilot program. Fannie Mae and Freddie Mac need to re-affirm their previous commitment to buying – and ultimately creating a flow and securitization program for chattel loans.

- … The FHFA must ensure that Fannie Mae and Freddie Mac meet their statutory Duty to Serve manufactured housing by increasing – not decreasing – their commitment to create a robust secondary market for all forms of manufactured housing. It is imperative that government financing be available for manufactured homes. It is the responsibility of the Enterprises to meet this obligation.

At the time this is being written (3:58 AM ET, 7.11.2021) by far the most interesting comments on the FHFA website are these from Philip “Phil” Schulte.

Before sharing several quotes from Schulte, some background is warranted.

Phil Schulte has previously told MHLivingNews that he worked in for HUD for years. He also had years of involvement in the FHA Title I lending programs as well as the manufactured home construction and safety standards. Specifically, Schulte said he left HUD “at the very end of the Clinton Administration [2000]. During the 1980s, I was the senior loan specialist for the FHA Title I program and I dealt primarily with manufactured home lenders.”

Rephrased, Schulte is an insider with specific knowledge of these issues. His full comments are linked here as a download.

The excepts that follow are in the view of MHLivingNews useful insights to newcomers on this issue. Following Schulte’s comments will be information from this writer’s March 25, 2021 DTS comments, as promised above. While Schulte’s format and approach are quite different than that of MHLivingNews/MHProNews, much of the core information, data and predicates are similar. A close reading will reflect that. How that information is applied may be distinctive.

Part of what makes Schulte’s comments so interesting is that he gets into granular details. Compared to those formatted responses by Clayton- and 21st Mortgage Corp. backed MHI and their state affiliates, Schulte laid out over 10 pages of facts and figures, charts and graphs. Both his background and the level of detail merit scrutiny. While some of this gets technical, it is not necessary to grasp the nuance to reap the benefits of his research summary.

Notice: for those who may want to file their own comments to FHFA, there is no specific format that needs to be followed in a letter or comments.

That said, Schulte’s format differs from that of several state manufactured housing associations and is a professional format. Ellipses (…) below reflect skipped content to focus on what is shown below. Highlighting is by MHLivingNews, but the comments shown are as he wrote them.

REQUEST FOR INPUT:

FANNIE MAE AND FREDDIE MAC PROPOSED 2022-2024 DUTY TO SERVE PLANS

Philip W. Schulte July 6, 2021

Comments Concerning the Enterprises Duty to Serve Plans for 2022-2024

…

A. There is No Progress toward A Secondary Market For Personal Property Manufactured Home Loans

The absence of an Enterprise secondary market for personal property manufactured home loans is the largest obstacle to increasing choice for low-moderate income consumers and increasing liquidity in the availability of credit for this underserved segment of American society. In the latest DTS plans for Underserved Markets, the Enterprises have both proposed to stop the development of a secondary market for manufactured home personal property (chattel) loans. Three quarters of the new manufactured homes are sold as personal property so increasing mortgage lending for permanent foundation manufactured home loans does not help with this underserved market.

…

2. So, FHFA and/or the Enterprises are distinguishing among the Duty To Serve underserved submarkets. The question is why? Discussion of how to accommodate both objectives (a liquid manufactured home chattel market operated safely and soundly) will be the majority of these comments (see Part III).

…

10.

A. More Transparency on the Part of FHFA Would Enhance the Public Participation Process

Yes, there are significant safety and soundness concerns about any type of home lending, including manufactured home personal property loans (“chattel loans”). Fannie Mae stated in its 2022-2024 DTS plan that the Enterprise would “continue to work with our regulator to understand safety and soundness considerations and the viability of a chattel loan pilot program”. Freddie Mac made a more direct statement that it was “not able to work through safety and soundness considerations with FHFA for a proposed pilot and bulk loan purchasing activity”.

FHFA has not explained the specific reasons for its conclusion that such a program cannot be operated today in a safe and sound manner. Because these objections are unstated, the public has no way to assess if there is additional information or evidence that might allay these FHFA concerns. These objections could be addressed as a critical part of the public outreach and listening sessions.

It is important to note that there are a small number of manufactured home chattel lenders who are successfully making loans (see Table Eight: Page 11 of these comments). However, a single family mortgage market consisting of mainly home builder finance companies would not be a liquid or competitive market.

B. Safety and Soundness in Lending Operations

- Safety and Soundness Principles

FHFA established two principles for the operation of the Enterprises under conservatorship. (https://www.federalregister.gov/documents/2008/09/09/E8-20839/establishment-of-a-new-independent-agency). The first principle is that Enterprises operate prudently in a safe and sound manner (protection of the taxpayer). The second principle is operations consistent with the public interest by “foster[ing] liquid, efficient, competitive, and resilient national housing finance markets”.

In fostering this public purpose, the Enterprises would allow a lesser economic return for activities dedicated to low- and moderate-income families. Implicit in this principle is that public purpose operations directed to low-moderate income Americans should not be money losing operations but a lower economic return is permissible. In addition to meeting the operational goals, the Enterprises must maintain adequate capital, internal controls and follow FHFA rules.

…

##

Once again, Schulte’s presentation is technical in several respects, which has its advantages. But a lack of technical insights should not deter readers who may want to comment themselves from weighing in.

That said, a few more pull quotes will shared, because it gets to the kinds of issues – think, excuses – that Fannie, Freddie, and FHFA may attempt to use.

Note that the thrust of Schulete’s presentation is a step-by-step case why the GSEs could be doing such personal property loans. That point was illustrated earlier through the range of quotes from a spectrum of industry and other professionals.

With the above in mind, Schulte also noted the following.

(b) Debt to Income Ratios

Based on the HMDA data (median chattel borrower DTI ratio of 35.5%), the base DTI range was set at 34-38% with the highest ratio (44-50%). The default risk does not change substantially regardless of debt to income ratios (see Table Four). Therefore, some latitude could be allowed for consumers, especially younger first time home buyers with high debt to income ratios at present but who will likely see income increases later in life.

…

(c) Credit Scores

The credit score default data is far different than the previous debt to income ratios. Moving from a credit score of 620 to a minimum of credit score of 660 cuts the default risk by a third (see Table Five). The change is similar to what occurs in downpayments. ##

##

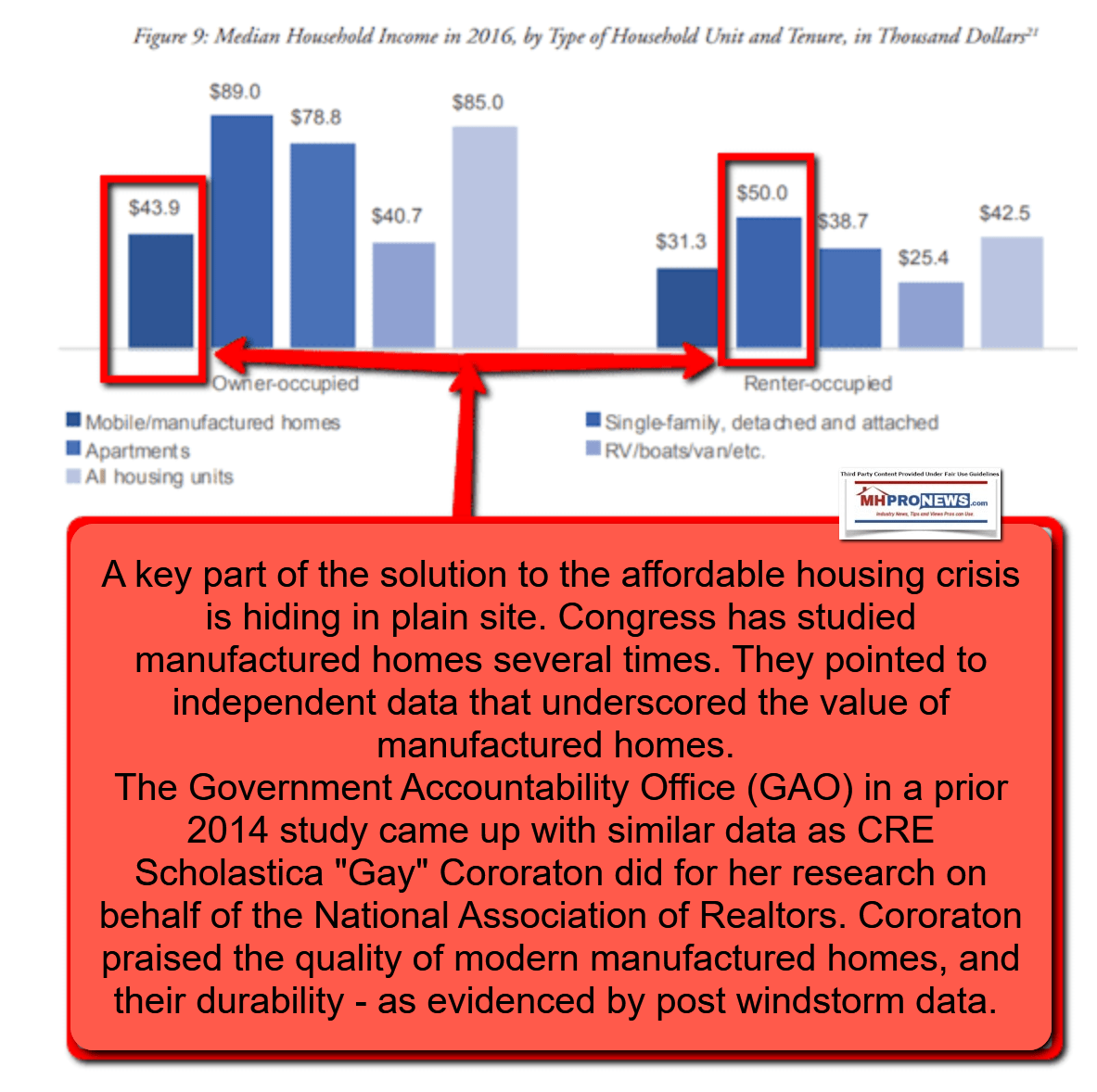

Schulte then raises what MHLivingNews believes is a highly relevant issue to current and prospective manufactured home owners. Years of research already demonstrates that a manufactured home can and does appreciate for the same types of reasons as conventional housing. The report linked below goes into detail, based upon third-party research.

Schulte, in referring to the recent data from the CFPB, points out that a failure of the GSEs to make personal property loans is hampering refinancing. Quite so. For those who have a loan at a higher interest rate, this is an important issue. NAR – plus GAO data for that matter – makes it clear that even with a higher interest rate, a manufactured home still saves buyers money over buying a conventional housing of a similar size. Nevertheless, it should be obvious that lower rates and access to refinancing would be good for millions of current and potential manufactured home owners.

Per Schulte:

(e) Loan Purpose (Primary Residence, Refinancing)

Manufactured home buyers intend to occupy their home as their primary residence. Also, the CPFB report referenced above shows that the percentage of refinanced chattel manufactured home loans was 3.4% of the total chattel loans. Refinancing of loans is less common for a number of reasons, including the absence of lenders willing to make these loans on acceptable terms….

Table Six: Manufactured Home Loan Loss and Loan Charge-offs for the Last 20 Years

| Year |

Percentage of Loss Reserve to Outstanding Portfolio Size

|

Percentage of Loan Charge-offs to Outstanding Portfolio Size |

| 2020 | 4.16% | 0.69% |

| 2019 | 0.79% | 0.85% |

| 2018 | 0.96% | 0.98% |

| 2017 | 1.17% | 1.18% |

| 2016 | 1.08% | 1.08% |

| 2015 | 1.13% | 1.35% |

| 2014 | 1.34% | 1.66% |

| 2013 | 1.99% | 2.13% |

| 2012 | 2.47% | 2.68% |

| 2011 | 2.61% | 2.49% |

| 2010 | 2.54% | 2.59% |

| 2009 | 3.09% | 2.72% |

| 2008 | 2.42% | 1.71% |

| 2007 | 1.59% | 1.77% |

| 2006 | 2.12% | 2.45% |

| 2005 | 2.44% | 1.16% |

| 2004 | 1.55% | 1.32% |

| 2002 | 2.20% | |

| 2001 | 1.80% | |

| 2000 | 1.40% | |

| 1999 | 1.40% | |

| 1998 | 0.80% | |

| Median | 1.99% | 1.66% |

…

- Fannie Mae and Manufactured Home Lender Loss Reserves

According to Fannie Mae’s 2019 financial report, the loss reserve for single family loans is .3% of the outstanding guarantee book of business. This is roughly 1/3th of the manufactured home loss reserve shown in Table Eight below.

Table Eight: Losses Reserves for Fannie Mae and Manufactured Home Lenders

| Year | Fannie Mae | Manufactured Home Lenders |

| Single Family: Loss reserves as a percentage of guaranty book of business: | Provision for Loan Losses as Percentage of Portfolio | |

| 2020 | 0.30% | 4.16% |

| 2019 | 0.30% | 0.79% |

| 2018 | 0.49% | 0.96% |

| 2017 | 0.65% | 1.17% |

| 2016 | 0.83% | 1.08% |

| 2015 | 1.00% | 1.13% |

| 2014 | 1.28% | 1.34% |

| 2013 | 1.55% | 1.99% |

| 2012 | 2.08% | 2.47% |

| 2011 | 2.52% | 2.61% |

| Median | 0.92% | 1.25% |

…

- Given the limited number of manufactured home lenders, you would not expect competition to be robust.

Table Eight: Top Manufactured Home Chattel Lenders

| Consumer Finance Protection Bureau

Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure Act Data |

||

| 2019 HMDA Data Highest Volume Manufactured Home Chattel Lenders | ||

| Name of Lender | Number of Loans | Market Share |

| 21st Century | 17,900 | 46.13% |

| Vanderbilt | 9,000 | 23.20% |

| Triad Mortgage Services | 6,100 | 15.72% |

| Credit Human FCU | 2,700 | 6.96% |

| Cascade Finance Services | 1,300 | 3.35% |

| First Bank | 800 | 2.06% |

| CountryPlace Mortgage Ltd. | 400 | 1.03% |

| First Advantage Bank | 600 | 1.55% |

| Total Chattel Loans | 38,800 | |

…

Diversity and Inclusion

In its 2021 New Insights report, the Consumer Finance Protection Bureau concluded that “Hispanic, Black and African American, American Indian and Alaska Native, and elderly borrowers are more likely than other consumers to take out chattel loans, even after controlling for land ownership”. The illiquidity of the current marketplace is offering fewer lender choices to these Americans. Also, higher interest rates increase interest costs and allow for a slower accumulation of wealth.

…

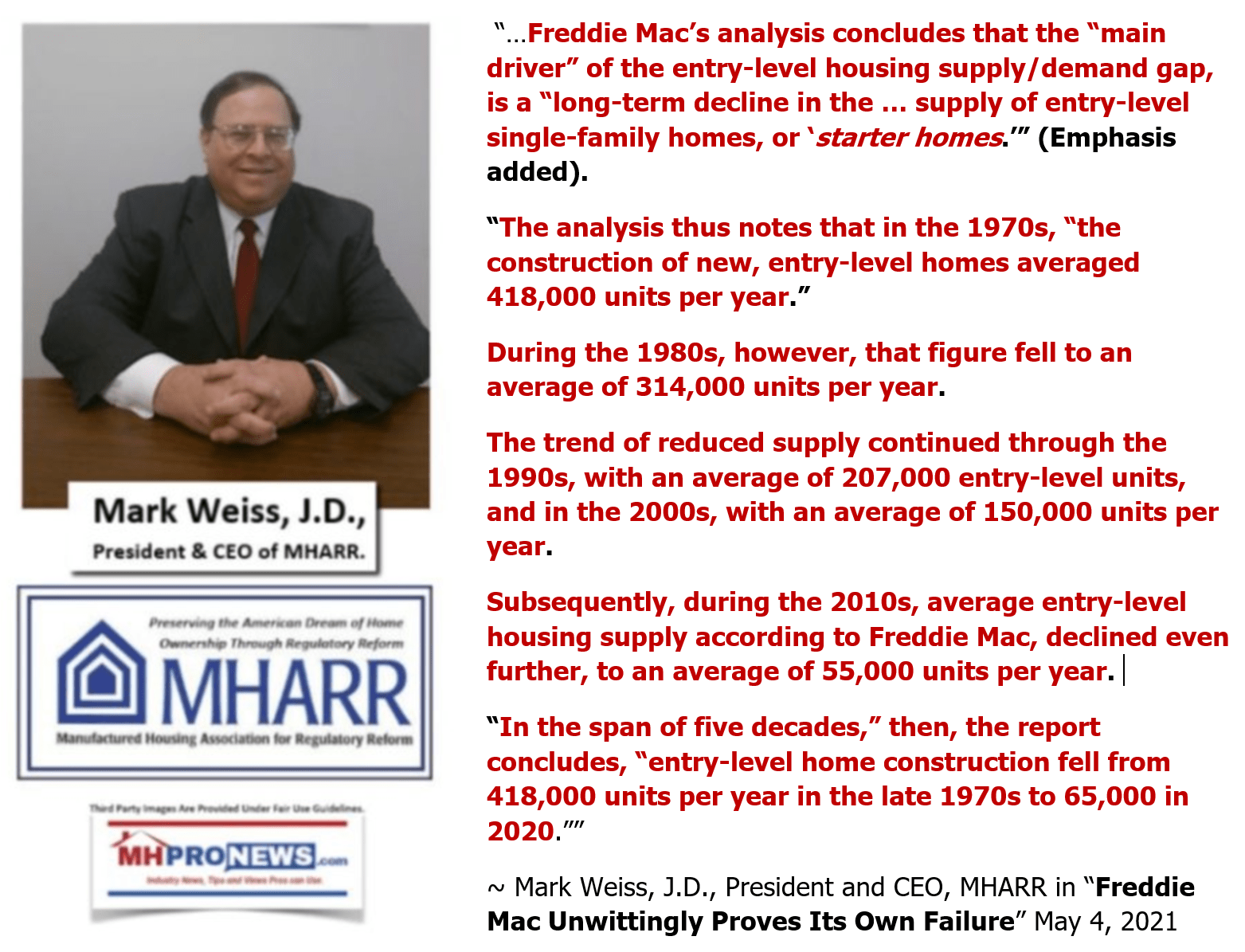

Opportunity for the American Dream and the Shortage of Affordable Housing

A companion to diversity is opportunity to become a homeowner. While about 8% of Americans live in manufactured homes, the market penetration in growth areas like the South Census Region is greater than the national average. As noted in the Freddie Mac DTS plan, there is a significant shortfall in single family housing production with the lowest end of the market having the greatest undersupply. Also, the production shortage is coupled with the largest US generation (the Millennials) who are now in their prime first home buying period. A chattel loan market would help encourage more affordable home production.

New Loan Products and Manufactured Home Chattel Loans

The Enterprises have introduced new products such as energy efficient mortgages (Homestyle Energy mortgages, GreenChoice mortgages) where there does not appear to be long term data to fully assess credit risk and there were relatively few lenders who had the experience to give the Enterprises the information. Yet, the enterprises introduced these new products anyway, why?

Because there is a strong public purpose in fostering energy efficiency. One of Fannie Mae’s Duty to Serve objectives is to fund loan purchases for energy or water efficiency improvements (see G. Regulatory Activity: Energy or water efficiency improvements on single-family, first lien properties that meet the FHFA Criteria (12 C.F.R. § 1282.34 (d) (3)), items 2 and 3). Congress has determined that there is a public purpose in making affordable manufactured homes more available.

…

Fairness to all Americans and the Wealth Gap

Income inequality and the absence of the American dream of homeownership for many low to moderate income Americans is one of the most important unsolved problems in America. In fact, cheap credit has bolstered asset markets and led to prosperity for some while less wealth creation for low to moderate income Americans. Many renters are potential manufactured home owners and they are restrained only because the illiquidity of the manufactured home lending industry.

…

- Conclusions and Recommendations for the Manufactured Home Chattel Pilot Progra

A. Safety and Soundness in Originating Manufactured Home Chattel Loans

The jigsaw puzzle that is manufactured home chattel lending is not fully complete but the default and loss data is sufficiently clear that loss origination and servicing could begin under safe and sound lending terms. If the Enterprises continue to merely discuss the matter with FHFA, low-moderate income Americans will continue to be underserved as there is little indication that private capital is entering this line of business absent government action.” ##

To sum up. Schulte has provided a rare and unique analysis among all those posted to date in this sense. He has gone beyond the broad brush statements of professionals that have stated the obvious.

Current manufactured home lenders doing personal property or chattel loans have proven they are making such loans sustainably, responsibly, and in a fashion that the GSEs could emulate. But in addition to that evidence, Schulte’s rationale goes into details to make it clear that there are no excuses for the FHFA, Fannie or Freddie.

A video report by MHLivingNews posted below by two credit unions officials who are lending through Triad Financial Services (TFS) well established program glowed about manufactured homes. They also bragged about the fact that the loans they are making on manufactured homes are performing well. In another clip from a longer video, those same lenders asserted that the GSEs are missing the boat.

Note that none of the lenders reported by Schulte are clients of our firm. So, this analysis is motivated by the pure desire to see consumers benefit, which should in turn benefit ‘white hat’ manufactured home independents.

Summing up, there are no good excuses.

Schulte has done consumers and professionals alike a service by methodically unpacking data and addressing each aspect of the lending picture in a fashion that the GSEs – and FHFA – should not ignore.

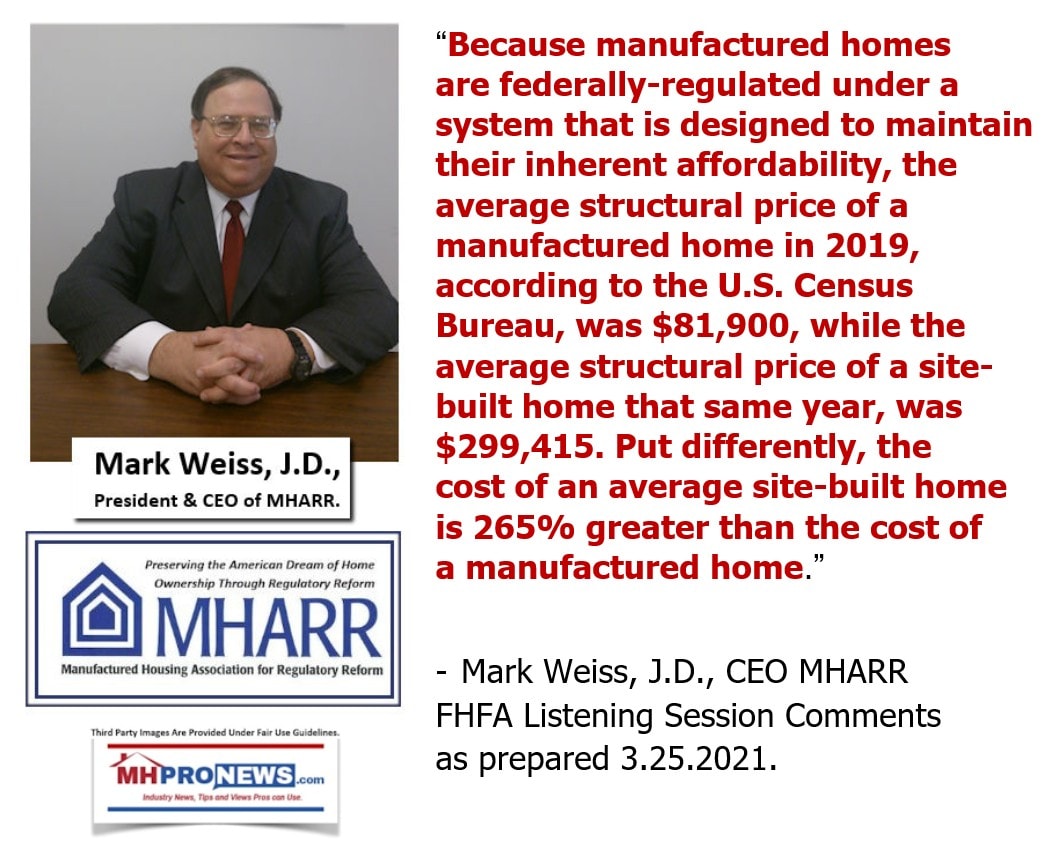

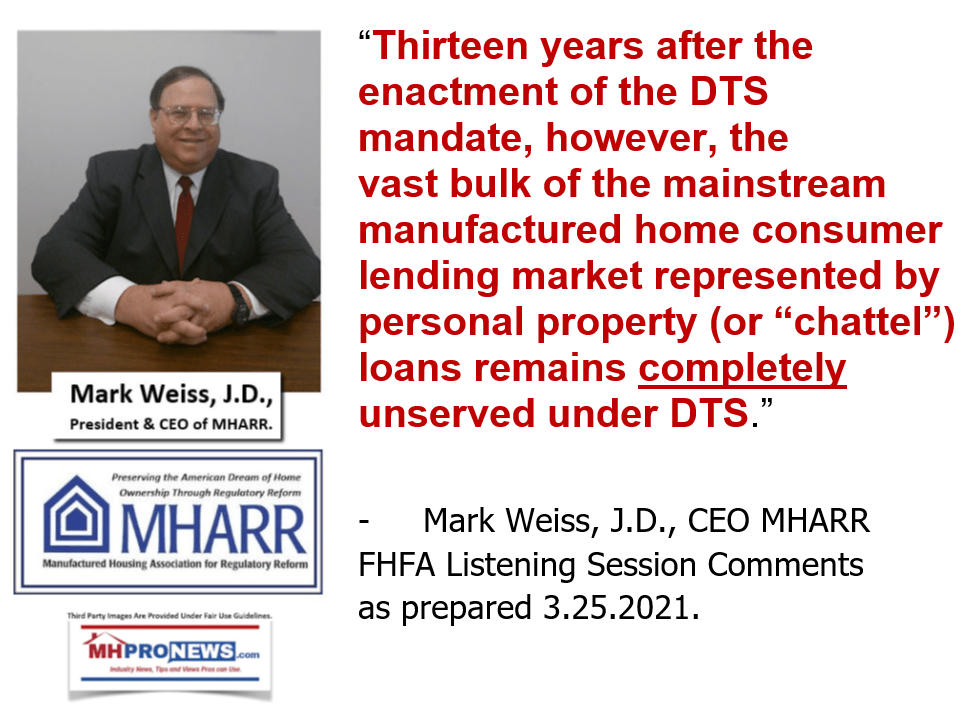

In a similar way, the comments on 3.25.2021 by the Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) makes the strong argument that what has been occurring is a “shell game.” Recall that Prosperity Now’s Ryan complained that MHI is not pushing FHFA and the GSEs harder due to Clayton, likely due to the loss of profits from their high interest rate lending. DTS would undermine Clayton/21st connected lending. Weiss thinking linked below exemplifies the kind of advocate that is willing to call the proverbial kettle black.

That said, sadly, the GSEs have ignored such insights from Schulte in the past. They have also ignored Wiess and all of those voices at MHI that posture that they want more lending, but who may or may not mean what they said.

It is against that backdrop, that the following comments shared by this writer below are all the more relevant. Because as Schulte and others have made it plain, manufactured home personal property loans can be properly originated and serviced in a manner that benefits almost everyone. The main exceptions who be who? Consolidators, a few companies like the Berkshire owned brands, and those who push more expensive housing and rental housing.

Rephrased, there are two broad groups we could describe. There are per the Apartment List 111 million Americans who are living in rental housing. Prior NAR research revealed that the vast majority of renters would rather own. Of course. That’s no surprise. Then there are some 22 million Americans of all backgrounds that live in a mobile home or a post-HUD Code manufactured home. Potentially 133 million Americans could benefit by simply by properly enforcing existing laws. But what about those in conventional housing? That’s another topic, but the argument can be made that many if not most of them would benefit too. See the thoughtful research linked here.

So, who is left that benefits from the status quo? It is the Berkshire brands, other consolidators, conventional builders, and those in the rental housing business. To the extend that federal or state appointed and elected officials may lose some clout if millions more became homeowners, other logical impacts exist. Some of that is rapidly reviewed in the comments below made during an FHFA/GSE so-called “listening session.”

IV. Prior and Relevant Comments by L. A. “Tony” Kovach posted at this link here on the FHFA website, but shown below for ease of reading. They were delivered on 3.25.2021. The title is quote, not this writer’s own words.

“A Pimple on an Elephant’s Ass.”

Despite that comparative pimple, Fannie Mae, Freddie Mac, and others periodically point back to that problematic so-called “GreenSeco era.” That’s 2 decades in the rearview mirror. How can that be an excuse for treating manufactured homes so differently than conventional housing in access to lending?

The FHFA website says that Enterprise Housing Goals are supposed to “FOSTER competitive, liquid, efficient, and resilient (CLEAR) national housing finance markets that support sustainable homeownership and affordable rental housing…”

Before and after passage of the Housing and Economic Recovery Act (HERA) of 2008 and the

Congressional mandate of Duty to Serve (or DTS) for manufactured housing by Fannie Mae, Freddie Mac – FHFA and other regulators have paid lip service to supporting manufactured homes. That negatively impacts millions. Who says?

HUD Secretary Marcia Fudge spoke recently about the tragedy of increased homelessness in America.

HUD’s sad report is fascinating because James Schmitz Jr. – a researcher for the Minneapolis Fed, and three colleagues – published reports accusing HUD and builders of collusion in deliberately undermining manufactured housing.

Schmitz and those researchers argued that collusion between HUD and builders is a case of “sabotage monopoly.”

They said that sabotaging collusion between HUD and builders increased homelessness, harmed minorities, and cut off the lower income class of all backgrounds from the benefits of affordable manufactured home ownership.

Schmitz and his colleagues wrote positively about the manufactured home option.

Scholastica “Gay” Cororaton’s research for the National Association of Realtors also praised modern manufactured homes.

What makes Schmitz and his colleagues’ charge of HUD’s role in “sabotage monopoly” more compelling are comments from Bill Matchneer. Attorney Matchneer is the former HUD administrator for the Office of Manufactured Housing Programs (OMHP).

Matchneer said HUD’s Office of General Counsel consistently failed to enforce the enhanced preemption clause made law when the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform law) was enacted.

Jim Gray, formerly with the FHFA Duty to Serve program, said in his exit message that FHFA and GSEs – “[W]e have not made as much progress [toward meeting the Duty to Serve mandates] as many of us would have liked; so much remains to be done to reach these [DTS] markets.”

In December 2019, I made two different listening session presentations on the DTS mandates; one virtual and another live in Washington, D.C.

In both presentations, I made the evidence-based case how disgraceful it was that the FHFA and GSEs have ignored the law to the harm of millions.

GSEs and FHFA failures arguably included key corporate members of the Manufactured Housing Institute or MHI.

Several scheduled to present today are aware of the issues I’m raising. Because some worked for HUD, FHFA, GSEs, or are otherwise connected to the manufactured housing industry.

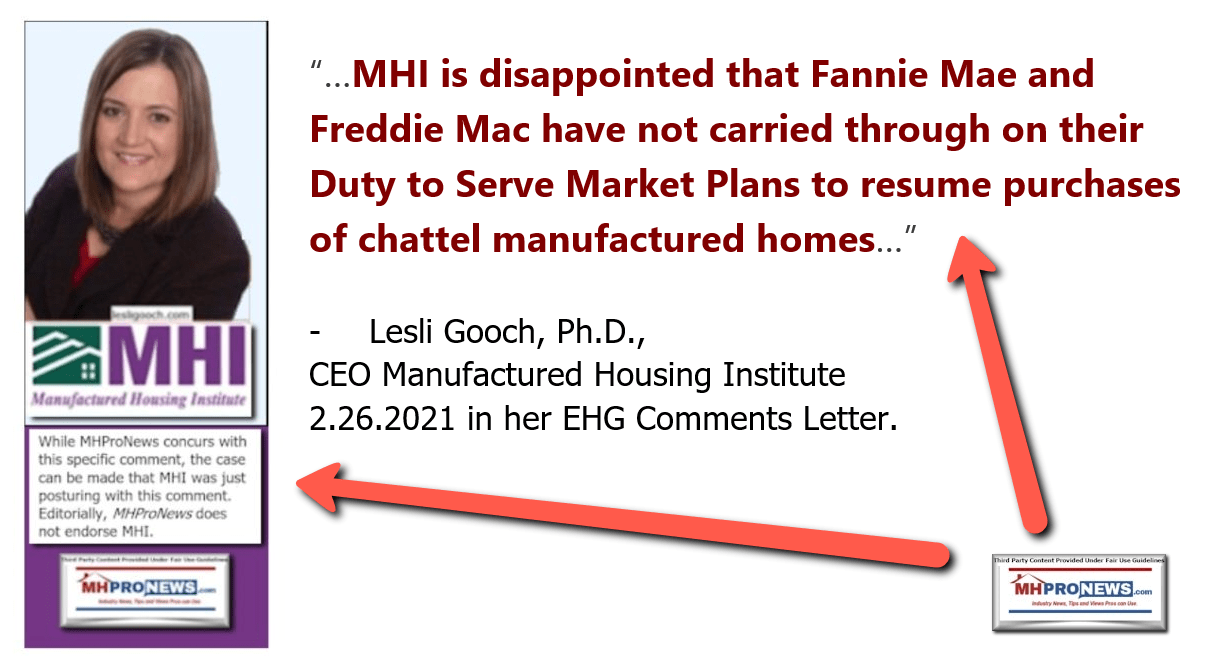

For instance. Lesli Gooch, Ph.D., with the Manufactured Housing Institute (MHI) made statements in her filed EHG comments letter that sound supportive of manufactured homes.

But upon closer examination, Ms. Gooch focused on an unproven plan that Berkshire Hathaway (BRK) owned Clayton Homes – which supports MHI – in their push for their branded CrossModTM homes scheme.

Where was Gooch’s similarly robust support for all other mainstream manufactured homes?

- Fannie calls CrossModTM MH Advantage®.

- Freddie calls their version of CrossModTM CHOICEHome®.

- The known data reveals that these programs are market failures.

Supposedly there have been double-digit sales nationally of CrossModTM – under whatever name – in the last few years. That’s in a market producing some 95,000 HUD Code manufactured homes annually.

Attorney and manufactured home finance veteran Marty Lavin – an MHI award winner – did consulting for Fannie Mae. Lavin told MHLivingNews that MHAdvantage ® was likely to be as successful as MH Select®. Lavin said MH Select® was also a virtual goose egg.

David Dworkin, CEO of the National Housing Conference in federal comments said that manufactured housing was necessary for affordable housing.

Dworkin was fully confident that the GSEs could successful do manufactured home loans. Dworkin previously worked for a GSE as a Vice President.

Edward Golding worked for HUD and the FHA.

In 2018, Golding and 3 colleagues did a post for the Urban Institute. It was a entitled “Manufactured homes could ease the affordable housing crisis. So why are so few being made?”

Citing FHFA data, Golding and his co-authors in that Urban Institute report said manufactured homes appreciated in value. They said manufactured homes could appreciate even more given access to affordable sustainable GSE loans.

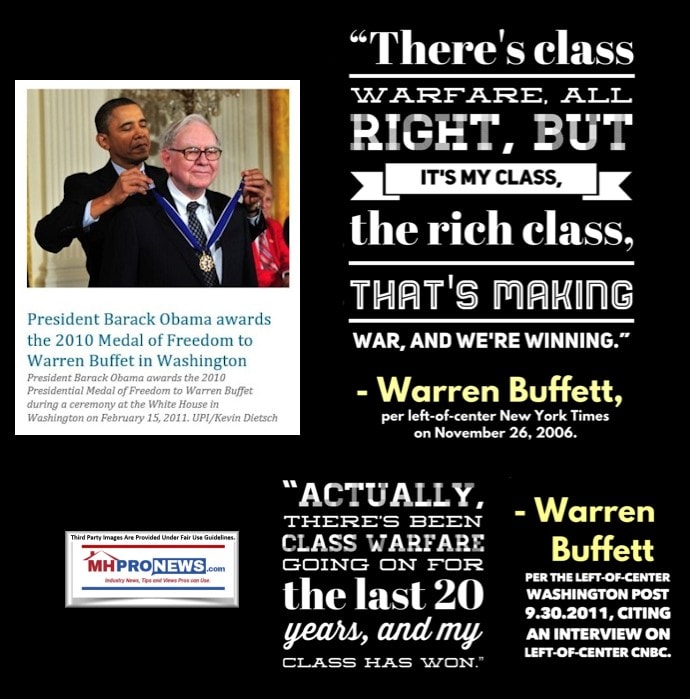

What that Urban Institute post didn’t disclose on that specific page is that Berkshire chairman Warren Buffett is a lifetime trustee of the Urban Institute.

The applied logic of Golding, Dworkin, MHARR’s Mark Weiss, and others should make it plain that the GSEs could and should be doing robust lending in manufactured housing.

Oxford Bank has made personal property loans on manufactured homes for some 2 decades. Oxford reportedly loans with credit scores that mirror those of Berkshire owned 21st Mortgage. Oxford purportedly does so profitably and sustainably and at lower interest rates than 21st.

Given those facts and legal mandates, what possible excuse can FHFA and the GSEs give for not robustly making mainstream manufactured home loans for both personal property as well as mortgage lending?

- Why did the GSEs and MHI hold closed door meetings some years ago and never released those meeting minutes?

- How did the MHAdvantage ® CHOICEHome® and CrossModTM magically come to be so similar?

- Why is it that MHI postures support, but has backed or tolerated plans that leave Berkshire owned 21st and Vanderbilt Mortgage and Finance as the 2 runaway largest lenders in manufactured housing?

I am consultant L.A. “Tony” Kovach. I’ve worked in the insurance, RV, trade show, and other professions. But all told, I have some 30 years’ experience in manufactured housing retail, communities, with financial service firms, and builders of HUD Code manufactured homes.

Keep in mind that I was an MHI member for years. I was elected by my peers to sit on the MHI Suppliers Division board.

For a time, I was arguably fooled by the purported paltering and posturing of the MHI flim-flam that has undermined manufactured housing.

That paltering pattern harms millions of Americans while thousands of independent retailers, producers, and others went out of business or sold out at discount.

- Is it mere coincidence that this history fits the Warren Buffett “castle and moat” methodology that Kevin Clayton himself bragged about in a video interview?

- Have you viewed or read the transcript of Kevin Clayton saying that Buffett preaches that Moat to make it hard on Clayton’s competitors?

Applying the “Iron Triangle” notion and Schmitz’s “Sabotage Monopoly” principles suggest that insiders rigged the market in ways that undermine the interests of various competitors.

The late Democratic Senator William Proxmire said that in Washington, two things shed light on what occurs.

- There are no coincidences.

- The other is follow the money.

I encourage all to Google each of these topics yourself!

—-

For instance, Google “Sam Strommen from Knudson Law” on manufactured housing research.

Strommen’s report called what is happening in manufactured housing a case of “Felony” antitrust violations with possible RICO aspects involved.

Strommen has no axe to grind in our profession.

Strommen concluded that manufactured housing was being subverted from within and mentioned Clayton, MHI, other MHI members, plus the Buffett “castle and moat” method too.

Given the degrees, evidence, and experiences of those involved, I have a hard time making the argument for incompetence causing the status quo.

The Rev. Martin Luther King Jr said:

“He who passively accepts evil is as much involved in it as he who helps to perpetrate it. He who accepts evil without protesting against it is really cooperating with it.”

What comes next should include a full and proper implementation of federal laws that include the

- Manufactured Housing Improvement Act of 2000,

- and the Duty to Serve Manufactured Housing as part of the Enterprise Housing Goals.

- It should also include enforcing antitrust and RICO laws too.

Those good laws need to be fully and properly implemented to restore the free market and liberate millions who want affordable home ownership made possible by mainstream manufactured homes. Pax et bonum. ##

###

Part V – Related Items, Summing up and Conclusion

In no specific order of importance,

- it seems odd at first that there is no apparent advocacy by an actual manufactured home consumer so far in the comments posted on the FHFA website.

- It is also odd that there is no advocacy yet by a group like MHAction.

- This author has heard numerous times from consumers that say the would want lower interest rates. Of course.

But lower rates, or an easier time getting refinancing on a manufactured home are clearly not going to happen on its own. Nothing will change until the status quo is challenged.

Whether or not someone accepts the notion:

- that MHARR advanced – that this DTS ‘process’ has been a 13 year shell game,

- or that this writer has made the case for – that this has been a corrupt process that is rigged to benefit a few at great cost to the many,

- there are other researchers and professionals who have come to a similar conclusion. To save time, we will show one important example.

Samuel “Sam” Strommen from Knudson Law has no known ties to this industry. His analysis of what has been occurring may reasonably taken at face value.

Strommen accuses several parties of violations of possible “felony” violations of antitrust and RICO laws, among others. Some pull quotes and the link to his full report will make the point.

For those consumers who can file comments by 7.17.2021, you can do so via the link below.

For those who missed that 7.17.2021 deadline, there is another option. It is one that MHARR has suggested several times.

Namely, that Congress or even state lawmakers should get involved. How so? Because lawmakers can often access subpoena powers to hold public hearings. They can take testimony under oath. They should see to it that Fannie Mae, Freddie Mac, and FHFA are each doing their respective jobs.

Comments to the FHFA could be as simple or complex as someone wants. It can be typed up and uploaded (see link above). Or it can be typed onto the FHFA submission link highlighted above. At least one comment was apparently emailed, this was the email address. DutyToServeStakeholders@fhfa.gov

If you are writing to your Congressional Representative or U.S. Senators, you could link this report and tell them you are sick and tired of the shell game. You could say you are tired of the system being rigged. That the law on DTS should be enforced, if they really want more Americans – including minorities – to become homeowners and build equity.

It can be useful to call and speak in your senator’s or representative’s office and sound off verbally too.

If 13 years of experience tells us anything, it is this. Nothing will change until enough Americans demand positive change. It seems obvious that MHI is doing what Doug Ryan alleged. They are working with regulators and the GSEs to make sure that the status quo remains unchanged. Is there evidence for that? Sadly, yes. Consider this:

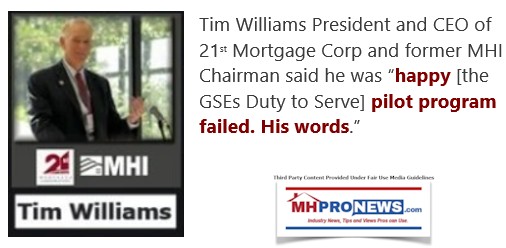

According to a whistleblower at MHI, Tim Williams/21st made that comment in the presence of dozens of MHI members. Note that MHProNews reported that shortly after the tip. Then, stop and think. That was months before the GSEs made their recent announcement that neither Fannie or Freddie would be doing any chattel lending, if their plans are accepted by the FHFA. That clearly implies foresight, knowledge, collusion or worse. Strommen isn’t alone in alleging corruption. After years of research that no one else in our profession can match, this writer has made that evidence-based claim several times.

- Do you want to see more affordable homeownership in America?

- Do you want to see more people that are able to build equity and get out of the rental trap?

- Do you want to see the market manipulators put in their place?

- Then fight for more affordable manufactured home lending under DTS. There are other programs that have been similarly thwarted, such as the FHA Title I loan program.

But the bottom line points are these. Politicians, regulators, and a range of officials all claim that they want DTS to happen. They claim they want more affordable home ownership. Of course. After all it is the law! But they are not enforcing an existing law. It is an outrage that harms tens of millions.

It is time to get others like yourself stirred up about this corrupt outrage. Two steps can start the ball rolling. Submit comments:

Then, contact your lawmakers. Tell them that if you do not see real change, you will remember come election time. ##

##

Postscript. The article linked here and again further below arguably compliments the above reasoning. It is pragmatic, peaceful, and achievable. It makes the point that there have been outrageous 21st century scandals that operated in plain sight for years. The massive and avoidable problems described in this article are hardly the first.

We can’t make people type out a comment that urges FHFA to enforce the DTS law and insist that there should be more competitive lending as Congress required.

But we can lay out the facts, evidence, and suggest that the odds are excellent that it would benefit you and virtually all of your friends to do so. It can be short and sweet. DTS is the law. Most manufactured homes are financed using personal property (a.k.a. home only or chattel lending).

It is time that those who claim to be working on behalf of consumers, groups like MHAction, do something that actually benefits their followers in a measurable manner. We will be challenge MHAction to make a similar push for the full and proper implementation of DTS.

“Capitalism without competition isn’t capitalism,” Joe Biden said per Frommers, before he signed an executive order that he claims will make air travel less costly. “It’s exploitation.” That comment was emailed yesterday from someone who may be an MHAction member. We’ll see what they will do on DTS comments between now and just before midnight on July 17, 2021.

The system is rigged. The way to unrig the system is for more everyday Americans to push back loud and proud. There are a lot of words in this report. Some may have to read this more than once. But it can all be boiled down rather simply. Enforce good existing laws. Citizens should press public officials to enforce good laws, and to legally punish the bad behavior of those who have rigged the system for their own benefit.

###

We lay out the facts and insights that others are too lazy, agenda driven, or are otherwise uninformed to do. That’s what makes our sister site and this location the runaway leaders for authentic information about affordable housing in general, the politics behind the problems, and manufactured homes specifically. That’s a wrap on this installment of “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

manufacturedhomelivingnews.com Manufactured Home Living News

manufacturedhomelivingnews.com Manufactured Home Living News