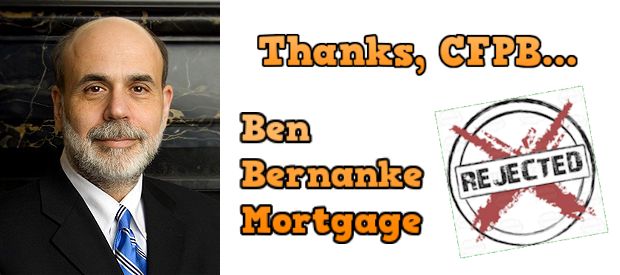

The attendees laughed, Bernanke told them he was serious, and the story went viral. But should Americans be laughing, or shaking their heads, since this reality impacts the ability of millions to buy or refi a home?

That in turn impacts housing values and the economy.

The first video news report on this subject is from CNN Money.

As you watch the second video from Bloomberg, here is what Wikipedia tells MHLivingNews about Ben Bernake:

“Bernanke was a tenured professor at Princeton University and chaired the department of economics there from 1996 to September 2002,” 2002 until 2005, he was a member of the Board of Governors of the Federal Reserve System 2002 until 2005, he was a member of the Board of Governors of the Federal Reserve System, and served as Fed Chairman from February 1, 2006 – February 3, 2014.

National Association of Realtors Graphic Show Economic Impact of a house sale beyond the home itself

There is speculation that computers that score loan risks, based upon CFPB regulations, declined Bernanke due to his ‘lost job’ at the Fed, even though he now reportedly makes as much in one speech as he used to make all year working as Fed Chairman.

But this goes to the heart of some consumer complaints, or those from community lenders, who ‘know their customers’ and therefor can consider factors that a computer model has difficulty rating.

Or what about those private investors willing to make higher risk loans, at a higher rate, but one that is still affordable for the borrower, and that gives “damaged credit” buyers a second chance?

Should the CFPB force investors and lenders to say “no” to those who want a home, have the down payment and can make the monthly payments?

CFPB Report on Manufactured Housing Fails to Cite facts Cited by the Government Account Office and Fannie Mae

The CFPB in their recent report (see link below) was quoted by the National Low Income Housing Coalition this way:

“Despite the low cost of manufactured homes, residents often pay higher interest rates than site-built residents…”

But the CFPB failed to underscore a fact prominent in the Government Accounting Office (GAO) report on manufactured housing. Even with a somewhat higher interest rate, because of their lower costs to buy and own, manufactured homes have a lower monthly payment than other housing options! That same fact was made by Fannie Mae, in an earlier report, summarized in their chart below.

See the CNBC news video and an article on

Payment vs. Price, linked here.

Manufactured Homes can be Financed More than One Way

Manufactured Homes (MHs) are unique because they can be financed the same as any other real property on land owned or being purchased by the buyer in a so-called ‘land home financed deal’ or mortgage. Those loans carry the same rates as other houses financed via FHA, VA or USDA loans. But MHs can also be financed as personal property or on a so-called “chattel loan.”

Personal property loans:

- are usually faster than a mortgage and may require less paper work,

- cost more to make or ‘originate,’ so

- they carry a rate that’s usually higher,

- but because the loans are for smaller amounts,

- have low or no closing costs,

- and interest can be tax deductible,

many choose this MH finance option.

Further, in the case of a home going on leased land, as in a manufactured home community (aka “mobile home park”), cash purchases or personal property lending are the most common.

There are consumer groups that advocate for lower rates on MH financing, and of course everyone wants a lower rate. But MH lenders respond by saying that it is simple business math that causes a loan to carry X rate, based upon:

- cost of funds,

- loan risk,

- the need to cover costs and make a profit.

Ben Bernanke isn’t the only one harmed by CFPB policies, millions of others are too

CFPB’s current regulations aren’t just harming Ben Bernanke; industry professionals say that while they are selling more homes in 2014 than before the new loan regulations went into effect, they’d be making even more loans if the regulations were more reasonable.

For example, many loans on homes under $20,000 or $25,000 aren’t being offered by lenders this year that were being made the same companies last year. Those lenders point directly to the CFPB rules as the reason why.

Many today can’t buy a conventional house on a mortgage that may require a larger down payment and have to meet the CFPB’s tough standards, but thousands of those buyers are turning to manufactured homes which have a lower price, lower down payments, lower monthly payments and operating/maintenance costs too. That certainly looks like a win-win.

CFPB or the Congress – which is working on a bi-partisan bill HR 1779/S 1828 to reform the CFPB’s Manufactured Home Lending standards – should reconsider their lending rules to make sure that more manufactured home buyers can make truly informed decisions while allowing them to buy a home they want and can afford. ##

(Editor’s Note: For those looking for an in depth look, with quotes from not-profit and business leaders across the spectrum, in manufactured home lending is found in this Industry In Focus Report).

manufacturedhomelivingnews.com Manufactured Home Living News

manufacturedhomelivingnews.com Manufactured Home Living News